$FLIP - Disrupting Thorchain's Native BTC Dominance

Summary:

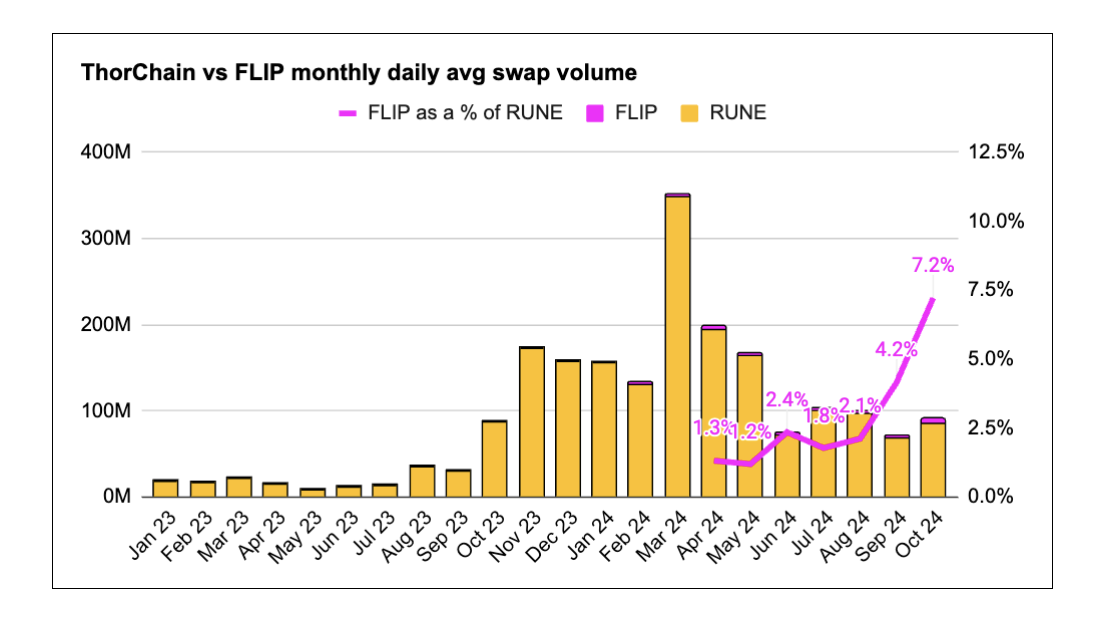

- ◆FLIP’s cross-chain’s swap volumes have ~3x (from $2.75M to the current $8.5M daily avg) since launching “DCA swaps” on Oct 8th, 2024.

- ◆Growth stems from FLIP's frontend only, with aggregator integration pending - representing significant untapped volume potential (around >$7M net new orderflow).

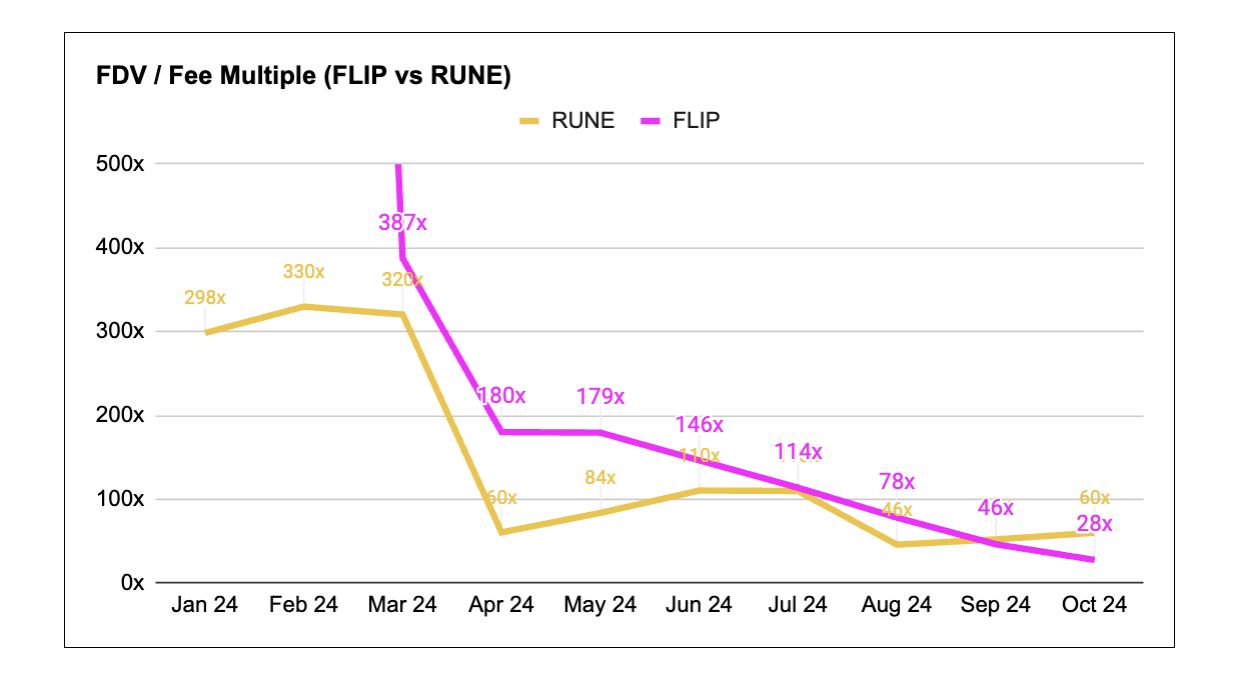

- ◆With an average total take rate on cross-chain swap volume of 0.177% (.1% from the network fixed fee, .05% from L14Ds average LP Fee, and .027% from L14Ds average Broker Fee) and at current FDV of $120M, FLIP is trading at a ~30x vs Thorchain at a ~70x FDV / Fees.

- ◆Base/bull case targets: 5-10x upside, predicated on: a) cross-chain swap volumes returning to prev ATH levels, b) FLIP capturing a modest share from Thorchain, c) Multiple naturally convergingback to its main comp, Thorchain, driven by more coverage of recent volume growth.

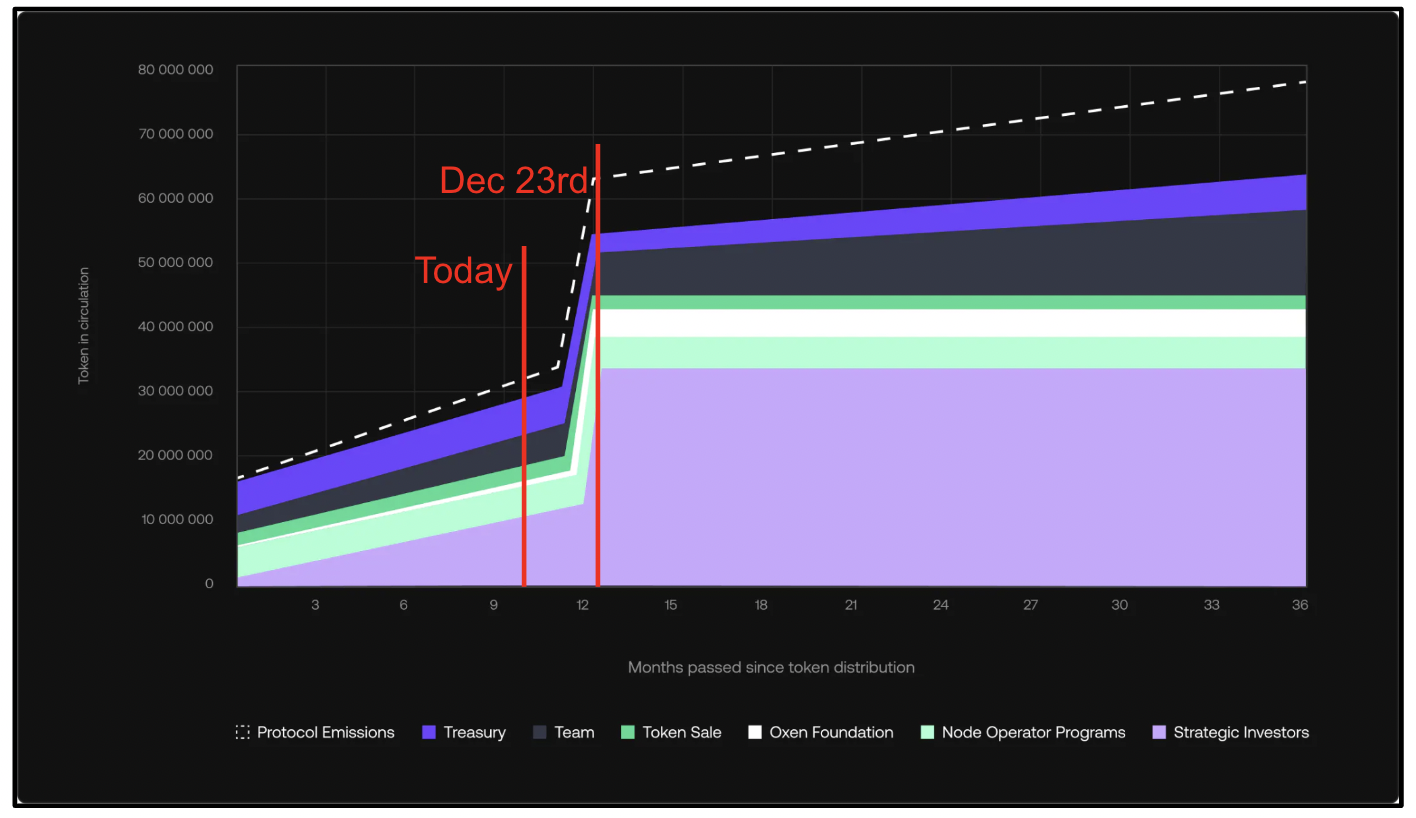

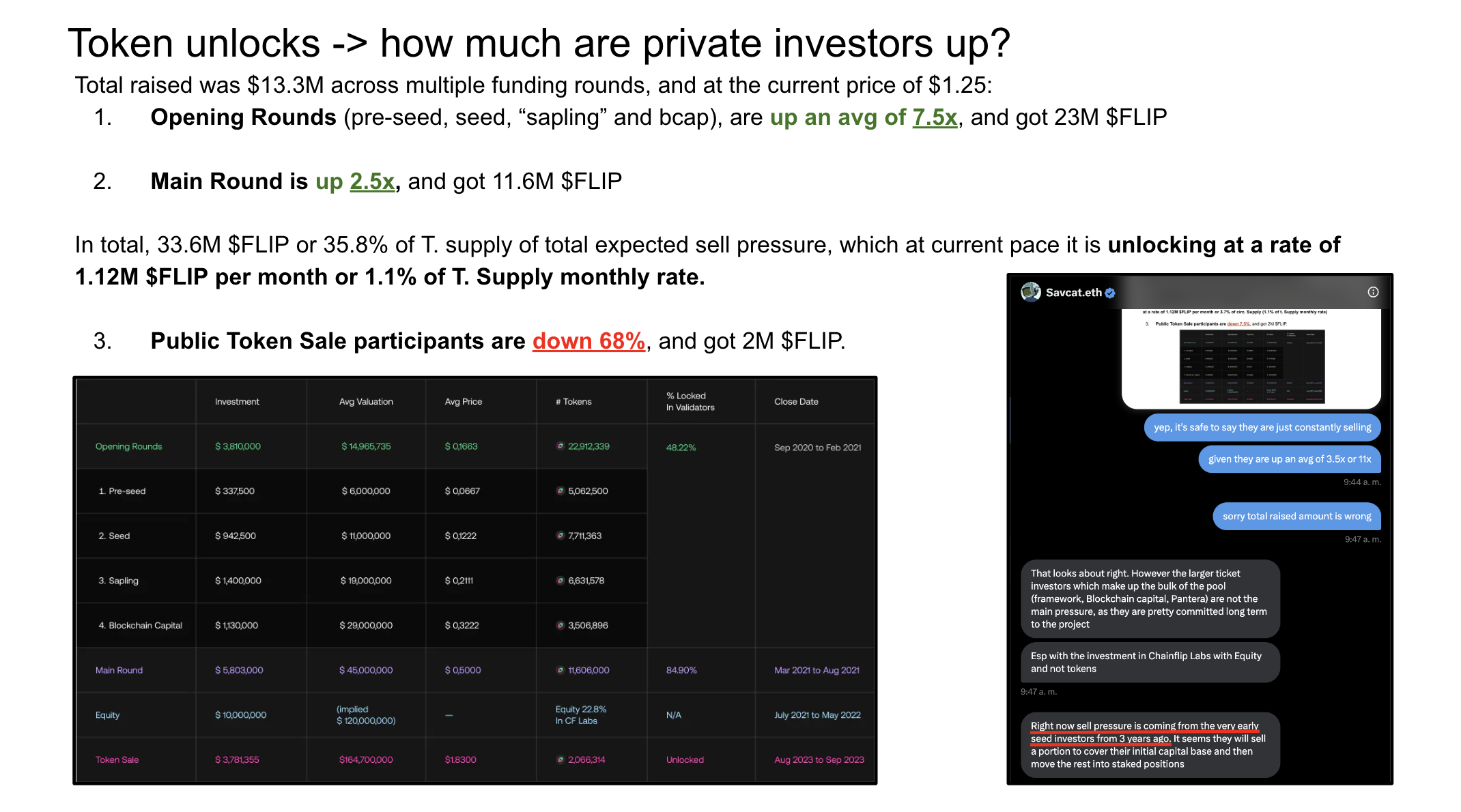

- ◆Key risk: Dec 23rd token unlock increasing float from 40% to >70%.

Investment Thesis

- ◆Volumes have 3x since the introduction of “DCA swaps”, which makes FLIP competitive on larger USD orders

FLIP's cross-chain swap volumes have tripled following the introduction of Dollar-Cost Averaging (DCA) swaps:

- ◆Pre-DCA: $2.75M daily average

- ◆Post-DCA: $8.5M daily average

The DCA functionality, comparable to Thorchain's streaming swaps, optimizes large-order execution by automatically splitting transactions into smaller tranches. This method:

- ◆Reduces price impact

- ◆Minimizes slippage on high-value trades

- ◆Enhances FLIP's competitiveness in the large-order segment of the market

The implementation has proven particularly effective for larger-amount transactions, marking FLIP's strategic push into the high-value order flow market, which was previously dominated by ThorChain. As a result, ChainFlip’s swap volume as a % of ThorChain’s has gone from 2% to 7.2%, and there is a clear path to comfortably reach 10-15% before the EOY.

https://scan.chainflip.io/swaps?page=1&limit=20

- ◆The next wave of growth should come from aggregators, which would enable FLIP’s access to >$7M net new orderflow. This is expected to go live in the coming weeks.

The short-term growth opportunity lies in pending aggregator integrations, potentially generating >$7M in additional daily orderflow. ThorSwap, the leading native BTC<>EVM swap frontend aggregator, processes $7-12M in daily volume. ChainFlip previously captured 10-15% of ThorSwap's volume, primarily limited by competitiveness in large-order execution. With DCA implementation and enhanced features (advanced rebalancing, increased LP liquidity), ChainFlip is positioned to potentially capture >50% of ThorSwap's market, translating to $4.5-6M in new daily orderflow.

https://app.thorswap.finance/swap

https://app.thoryield.com/volume

- ◆FLIP’s take rates are competitive and BTC native swaps is a big enough market

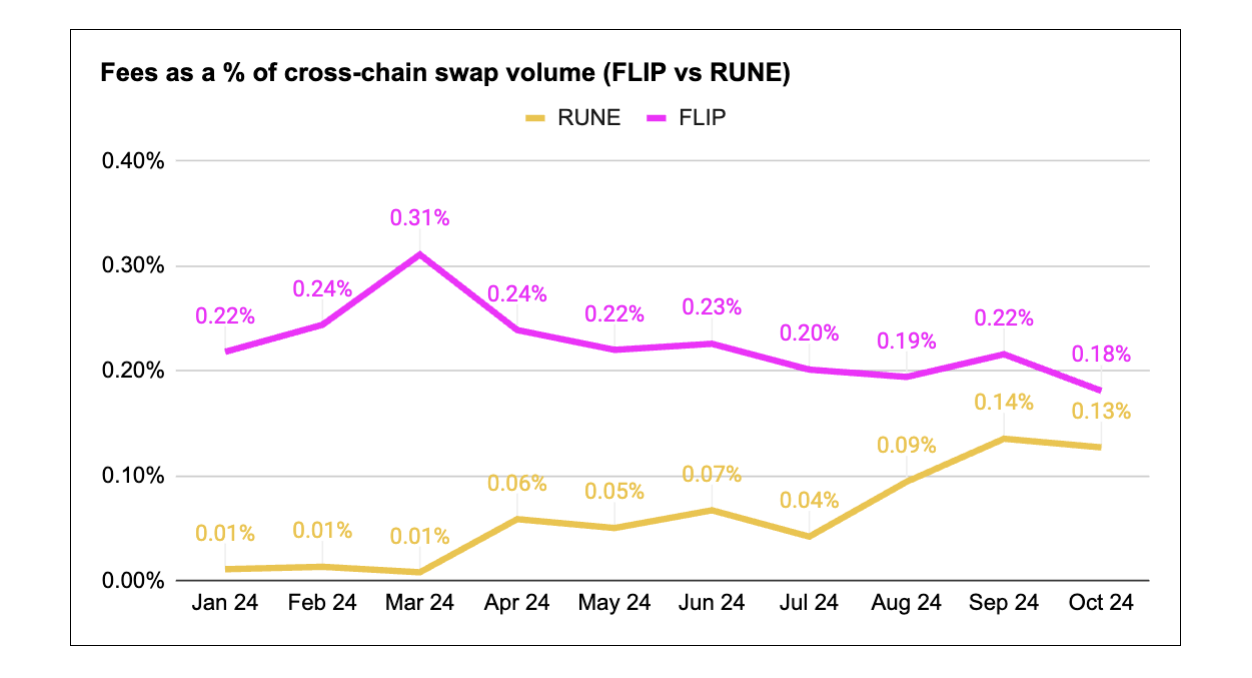

ChainFlip maintains a competitive total take rate of 0.177%, comprising of:

- ◆0.1% network fixed fee, which gets redirected to BBB $FLIP

- ◆0.05% average LP Fee (L14D)

- ◆0.027% average Broker Fee (L14D)

This rate has optimized from 0.31% in March 2024, with further improvements expected through:

- ◆Advanced rebalancing implementation

- ◆Increased liquidity attraction via competitive BTC yield APRs

The rate structure positions FLIP favorably against alternatives:

- ◆Solana wrapped BTC protocols: 0.15% for BTC to USD/ETH swaps

- ◆CEX operations: ~0.1% + >30-minute processing time

- ◆Decentralized options: Thorchain (0.13-0.14%), Maya Protocol (0.2-0.3%)

- ◆FLIP didn’t look attractive previously as it was trading very expensive relative to $RUNE’s FDV/Fees + had constant vesting unlocks, but current 25-30x FDV/Fees and $120M FDV should be a decent entry

- ◆Upside on the base case is 5x and 10x in the bull case

Key assumptions:

- ◆Native BTC cross-chain swap volumes returning to near-ATH levels (which happened on March 2024 with $350M daily average):

- ◆Base: $200M daily average

- ◆Bull: $300M daily average

- ◆FLIP captures a modest share from Thorchain, driven by aggregators integration (ThorSwap in the short term, and LIFI and Squid, other generalized aggregators, in the long-term) and goes from the current 7% to:

- ◆Base: 10%

- ◆Bull 15%

- ◆FDV/Fees Multiple to naturally converge to its main comp, Thorchain, driven by more coverage of the volume growth and share penetration dynamics + (naturally from the buyback).

- ◆Main risk are token unlocks, which the biggest one being the upcoming one on Dec 23rd, 2024

Appendix

Similar thing happened to Thorchain -FLIP’s main competitor- when they launched their “streaming swaps” on Aug 2023

After Thorchain released its streaming swaps product update their cross-chain swap volume went up 5.5x from doing $10M in daily volume to $55M, and since the start of the year they have been averaging around $140M in daily cross-chain swap volume.

Affiliate Disclosures

- •The author and/or others the author advises do not currently hold, or plan to initiate, an investment position in target.

- •The author does not hold an affiliated position with the target such as employment, directorship, or consultancy.

- •The author is not being compensated in any form by target in relation to this research.

- •To the best of the author's knowledge, the information provided here contains no material, non-public information. The accuracy of the information is the responsibility of the reader.

0

0