Meteora ($MET): The Liquidity Backbone of Solana’s Token Economy

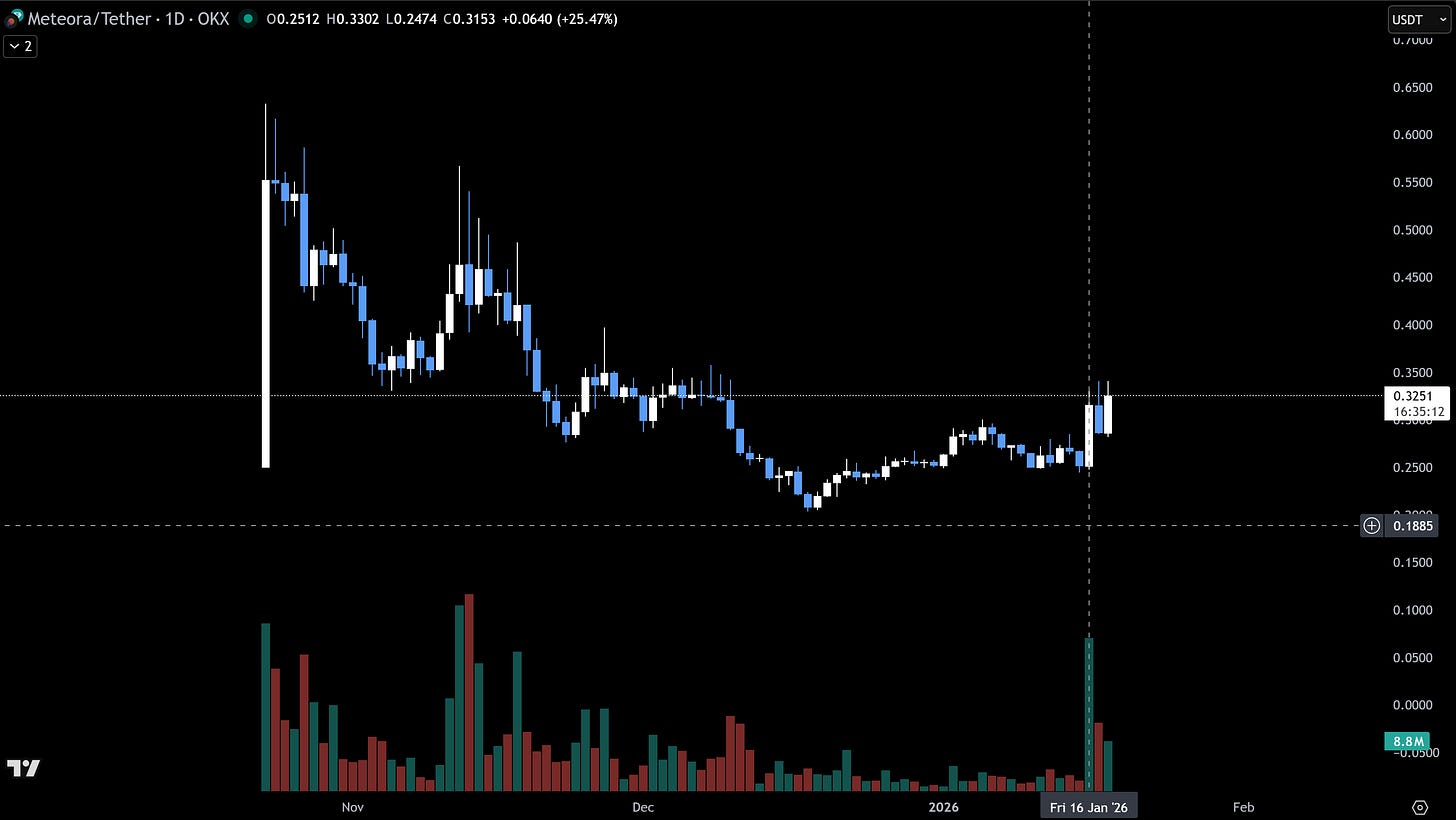

(2026 Jan 18) Update since original thesis: Several key catalysts have materialized. At the Met Dhabi conference (December 10, 2025), the team announced a $10 million USDC buyback program, acquiring 2.3% of MET’s total supply in Q4 2025, representing approximately 88% of that quarter’s revenue deployed toward value accrual. Alongside the buyback, Meteora introduced “Comet Points,” a consumable rewards system tied to MET staking and platform engagement, signaling deeper integration between token utility and product usage.

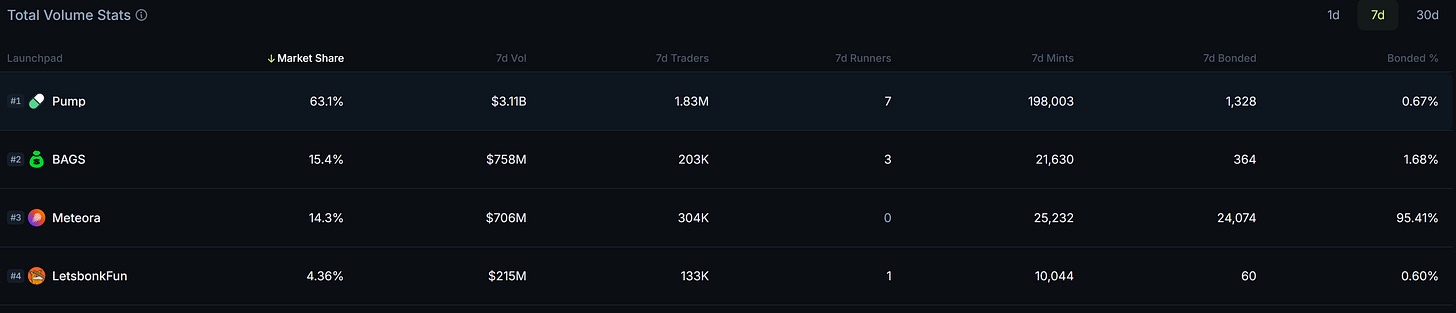

On the launchpad front, Bags.fm, built on Meteora’s Dynamic Bonding Curve (DBC) infrastructure, has emerged as a breakout catalyst for ecosystem attention. Activity on Bags.fm is spiking this week after the success of Gas Town’s token (GAS), with the platform ranking second on Jupiter’s launchpad leaderboard at approximately 15.4% market share. The creator-royalty model (1% perpetual fees to token creators) has attracted viral launches and mainstream exposure, including a livestream featuring MrBeast. This positions Meteora’s DBC infrastructure as the picks-and-shovels layer capturing fees across the Solana launchpad wars.MET is up 30%+, reflecting market participants connecting the dots between Bags.fm’s surge and Meteora’s underlying fee capture as the liquidity layer powering the platform.

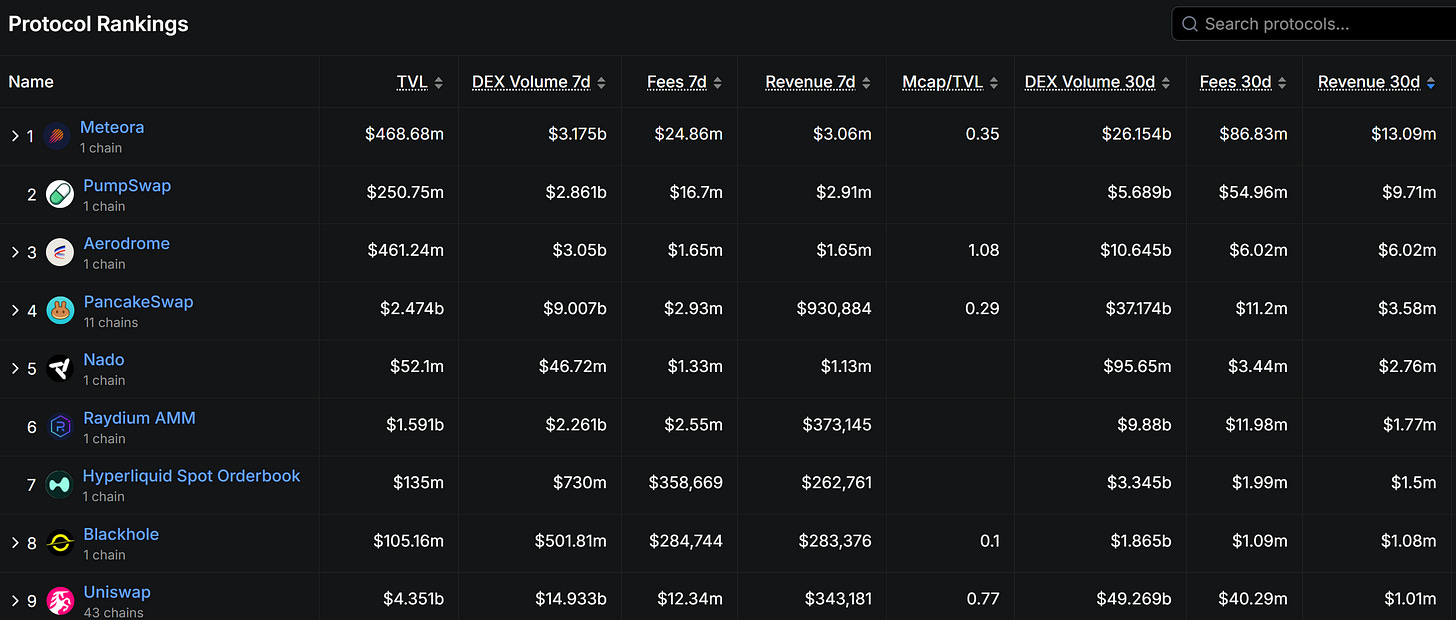

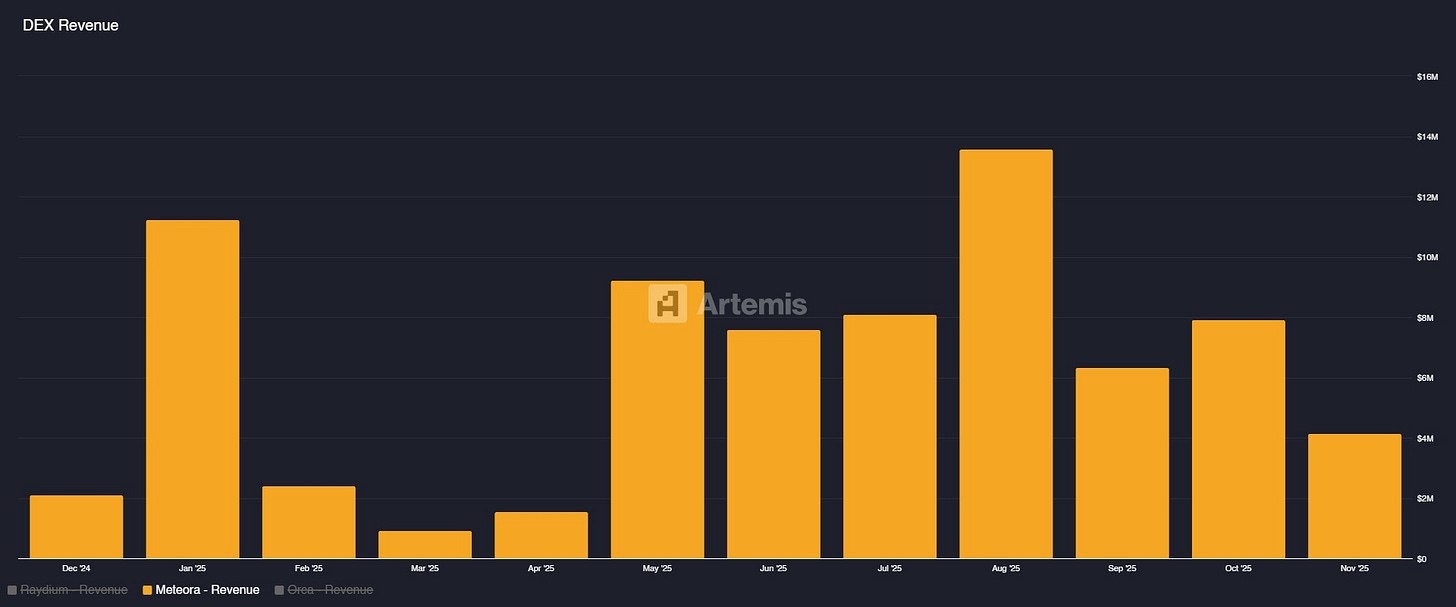

Perhaps most notably, Meteora now stands atop DEXs by 30D revenue at $13M, surpassing PumpSwap and Aerodome as of early January 2026, a structural shift validating the protocol’s dominant positioning within Solana’s liquidity ecosystem.

The valuation dislocation persists despite these operational milestones. As macro conditions stabilize and altcoin appetite returns, particularly with renewed interest in memecoin infrastructure and AI-agent token launches. Meteora stands well-positioned to capture institutional re-rating toward peers. The protocol’s demonstrated revenue sustainability, activated buyback mechanism, and monopolistic control over Solana’s highest-growth launchpad segment create asymmetric upside for patient capital awaiting broader market recognition.

EXECUTIVE SUMMARY

- ◆Meteora represents a rare fundamental mispricing in decentralized finance infrastructure, a protocol generating $50M annualized revenue while trading at a 6.6x FDV/Revenue multiple, representing a 61% discount to the peer median despite demonstrable operational superiority across every key metric and structural MOATs.

- ◆This dislocation creates asymmetric entry into Solana’s second-largest DEX by revenue ahead of imminent catalyst convergence. Two near-term catalysts drive re-rating within 30-60 days: Met Dhabi conference (December 10) , and anticipated buyback activation generating millions of annual buying pressure.

- ◆Valuation: Peer median convergence implies +56% upside, Raydium parity yields +261%. Initiate LONG position targeting catalyst-driven re-rating in recently-launched asset before institutional and retail recognition of operational superiority.

Update since original thesis: Several key catalysts have materialized. At the Met Dhabi conference (December 10, 2025), the team announced a $10 million USDC buyback program, acquiring 2.3% of MET's total supply in Q4 2025 Crypto Briefing—representing approximately 88% of that quarter's revenue deployed toward value accrual. The program has since expanded, with over $12 million USDC deployed to date, accumulating roughly 2.9% of total supply through approved market makers CoinStats. Alongside the buyback, Meteora introduced "Comet Points," a consumable rewards system tied to MET staking and platform engagement, signaling deeper integration between token utility and product usage.

On the launchpad front, Bags.fm—built on Meteora's Dynamic Bonding Curve (DBC) infrastructure—has emerged as a breakout catalyst for ecosystem attention. Activity on Bags.fm is spiking this week after the success of Gas Town's token (GAS), with the platform ranking second on Jupiter's launchpad leaderboard at approximately 33.5% market share and $293 million in daily volume The Defiant. The creator-royalty model (1% perpetual fees to token creators) has attracted viral launches and mainstream exposure, including a livestream featuring MrBeast. This positions Meteora's DBC infrastructure as the picks-and-shovels layer capturing fees across the Solana launchpad wars.

Perhaps most notably, Meteora now stands atop DEXs by weekly trading volume at $10.85B, surpassing Uniswap and PancakeSwap BlockchainReporter as of early January 2026—a structural shift validating the protocol's dominant positioning within Solana's liquidity ecosystem.

The valuation dislocation persists despite these operational milestones. As macro conditions stabilize and altcoin appetite returns—particularly with renewed interest in memecoin infrastructure and AI-agent token launches—Meteora stands well-positioned to capture institutional re-rating toward peers. The protocol's demonstrated revenue sustainability, activated buyback mechanism, and monopolistic control over Solana's highest-growth launchpad segment create asymmetric upside for patient capital awaiting broader market recognition.

I. INVESTMENT THESIS

Thesis 1: Market Share Capture in Explosive Growth Phase

Operational Momentum

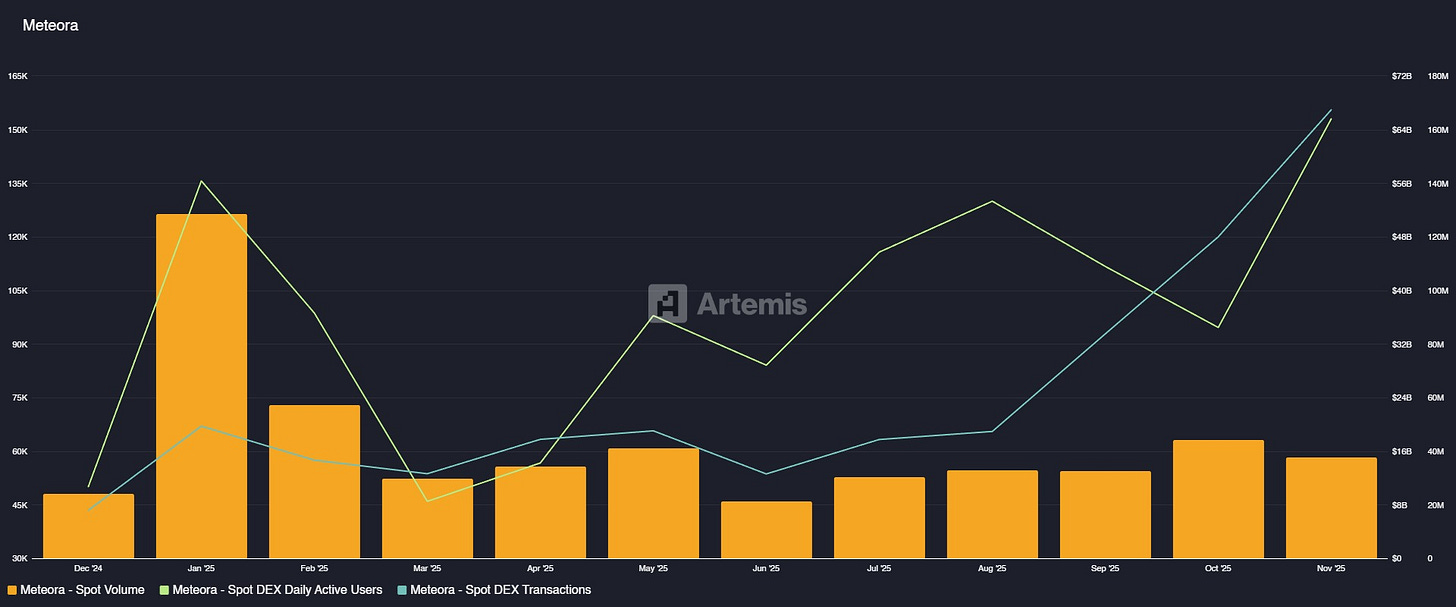

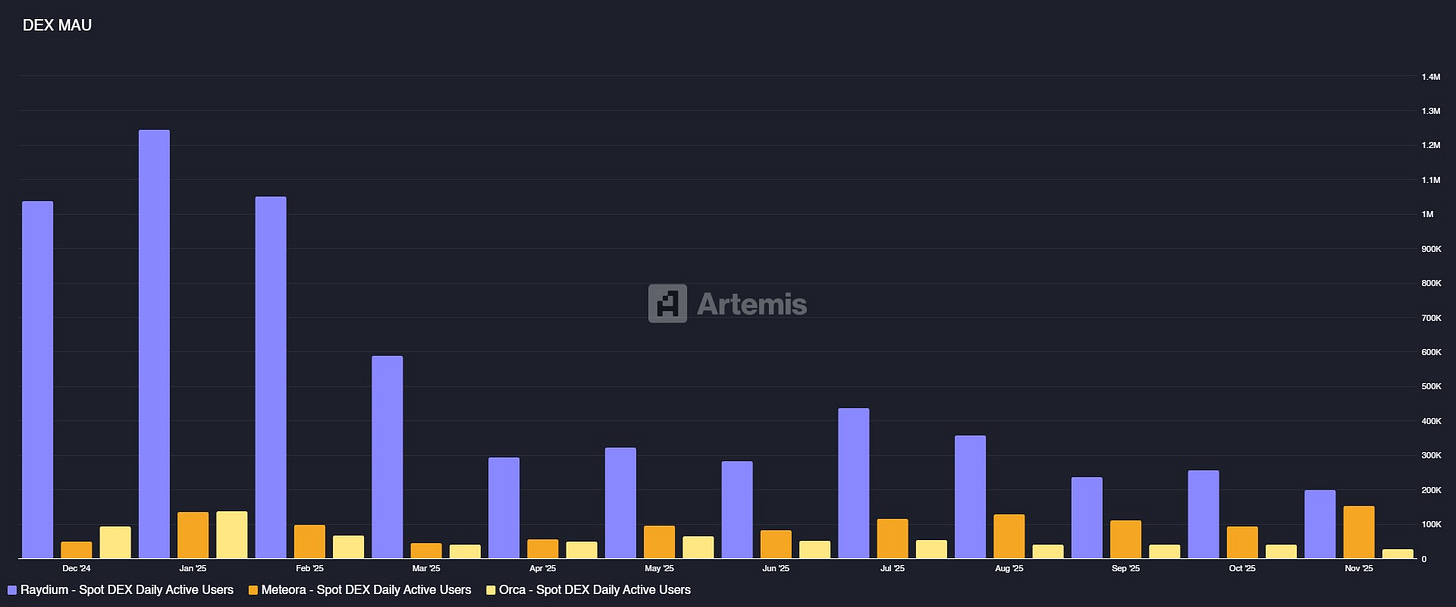

- ◆Meteora has demonstrated remarkable operational scaling over the past year, with trading volume surging 57% from $9.7B in December 2024 to $15.2B in November 2025. This consistent growth trajectory has positioned the protocol in close competition with Raydium for Solana’s second-largest DEX position by spot volume.

- ◆Daily active users now exceed 150K+ with strong user retention metrics, indicating sustainable product-market fit rather than transient speculative interest. The protocol processes over $500M indaily volume consistently, demonstrating infrastructure capable of handling institutional-scale throughput during both bullish and bearish market conditions.

Revenue Generation at Scale

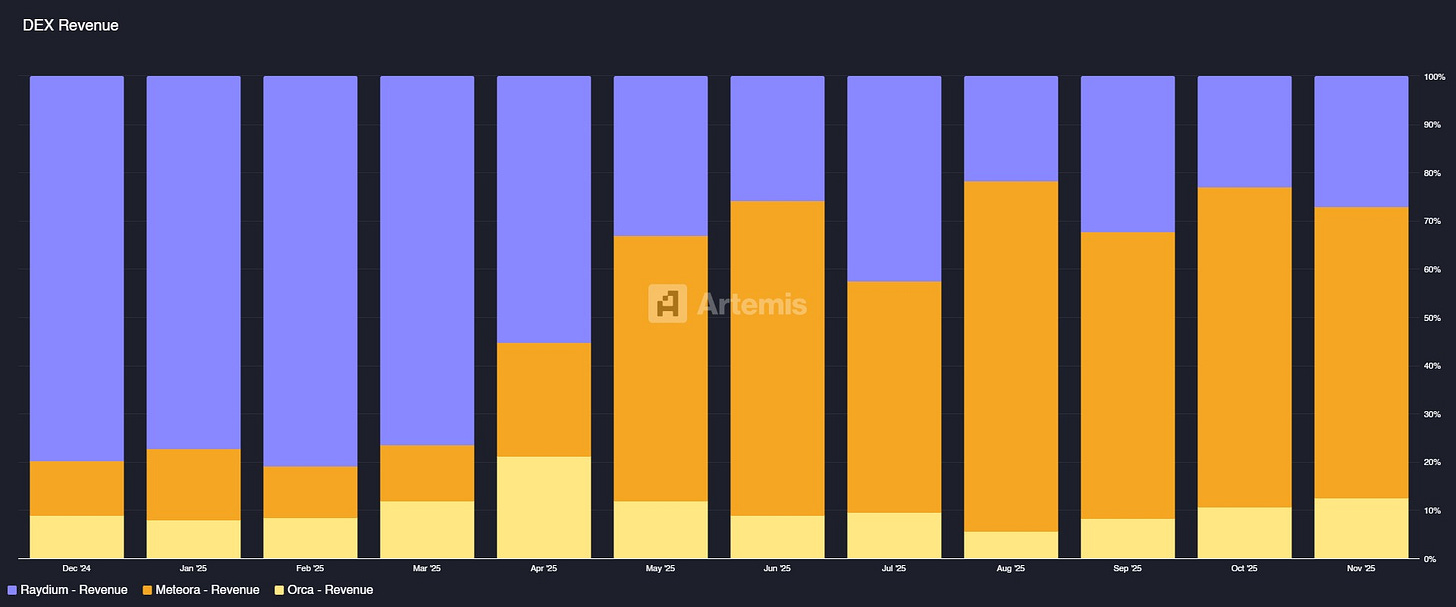

- ◆The protocol’s fee generation capabilities validate its operational thesis, with January 2025 producing $11M in monthly revenue at the peak of memecoin trading activity. Even during subsequent market downturns, Meteora maintained $4.2M in revenue over the most recent 30-day period. This revenue resilience during bearish conditions demonstrates pricing power and sticky user behavior characteristic of mission-critical infrastructure rather than speculative yield farming platforms.

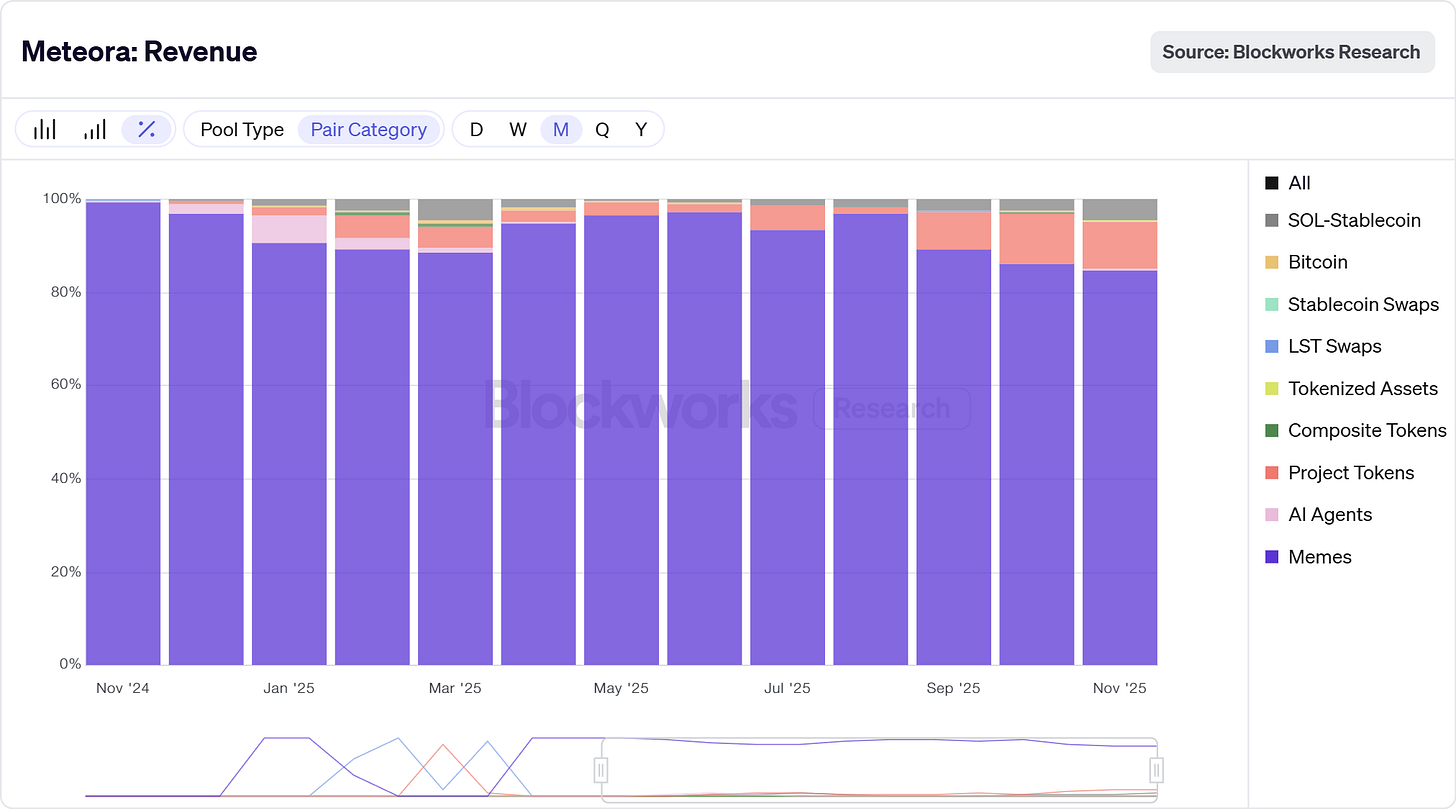

- ◆Notably, over 85% of protocol revenue derives from memecoin pools which command premium fee tiers due to higher volatility and trading frequency. This concentration, while appearing to present concentration risk, actually represents strategic positioning in Solana’s highest-margin market segment. At current run-rates, Meteora generates $75-115M in annualized revenue, placing it among the top revenue-generating DeFi protocols across all chains on a per-dollar-of-TVL basis.

Structural Advantages vs Competitors

- ◆Meteora’s competitive positioning benefits from multiple structural moats that compound over time. Unlike Orcawhich requiresmanual LP management, Meteora implements automated yield optimization that continuously rebalances capital across lending protocols without user intervention. This operational efficiency translates to higher effective APYs for liquidity providers through dual revenue streams, trading fees plus automated lending yield on idle capital, creating a powerful flywheel effect attracting capital from competing platforms. The protocol’s dynamic fee adjustment mechanism contrasts with Raydium’s static fee tier structure (ranging from 0.01% to 2%), allowing Meteora to automatically capture premium fees during volatility spikes while remaining competitive during stable conditions.

- ◆Jupiter’s routing algorithm, which handles approximately 80% of Meteora’s aggregated volume, increasingly prioritizes Meteora pools due to superior liquidity depth and competitive pricing. As a liquidity aggregator, Meteora creates adverse network effects for smaller competitors: Jupiter only routes trades to alternative platforms when slippage costs exceed Meteora’s fee premium, a scenario occurring rarely outside extreme market conditions. This positioning effectively marginalizes platforms like Orca from organic order flow.

Thesis 2: Superior Capital Efficiency Technology

Comprehensive Product Suite

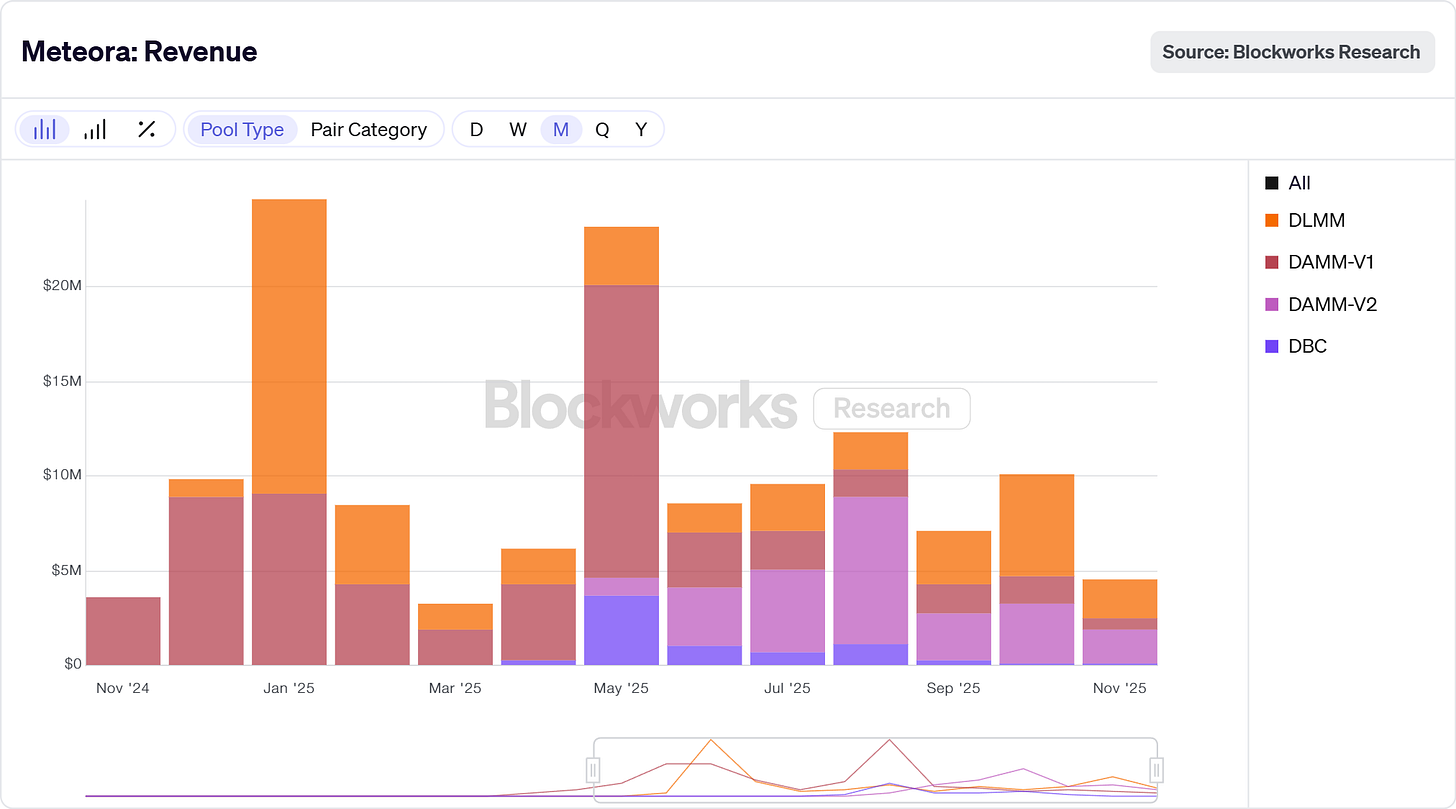

- ◆Meteora operates as a picks-and-shovels infrastructure provider for Solana’s on-chain economy, offering an integrated liquidity stack spanning trading, token launches, and yield optimization. The protocol’s three core technologies - DLMM, Dynamic AMM (DAMM), and Dynamic Bonding Curve (DBC) - function as composable liquidity rails similar to how Uniswap and Curve operate on Ethereum, but optimized for Solana’s high-throughput environment.

- ◆This multi-product architecture allows Meteora to capture value across the entire token lifecycle: from initial launch (DBC) to active trading (DLMM) to yield-optimized liquidity provision (DAMM). Unlike single-product competitors that specialize in either trading or yield generation, Meteora’s integrated approach creates network effects where each product strengthens the others.

DLMM: High-Margin Trading Infrastructure

- ◆DLMM organizes liquidity into discrete price bins with zero slippage within each bin, delivering 5-10x capital efficiency versus traditional AMMs. Dynamic fees automatically surge during volatility to compensate LPs for impermanent loss risk while remaining competitive during stable periods. This architecture is purpose-built for memecoin trading, the protocol’s primary revenue driver generating 85%+ of fees through high-margin volatile pairs. Single-sided liquidity provision and flexible distribution shapes (Spot/Curve/Bid-Ask) attract both retail traders seeking low slippage and institutional market makers optimizing capital deployment across Solana’s memecoin economy.

Dynamic AMM: Dual Revenue Stream Innovation

- ◆DAMM v1 pools integrate with Dynamic Vaults to create dual revenue streams by automatically deploying idle capital to lending protocols (Solend, Marginfi, Tulip), with the Hermes keeper rebalancing every minute. LPs earn from multiple sources (AMM trading fees, lending interest on idle capital, and platform liquidity mining rewards where available), stacking income compared to competitors capturing only trading fees. This innovation attracts sticky institutional liquidity essential for protocol stability, particularly from stablecoin providers who can now generate meaningful yield on otherwise dormant assets. LPs can permanently lock liquidity while continuing to claim fees, raising community confidence without sacrificing income generation.

DBC: Token Launch Funnel

- ◆DBC’s Universal Curve system enables launchpads to design customizable bonding curves with anti-sniper protections (fee schedulers, rate limiters) ensuring fair distribution. Tokens launch with immediate Jupiter integration for instant trading, then auto-migrate to DAMM/DLMM pools upon reaching thresholds. This end-to-end infrastructure powered 200+ launches in 2025, establishing Meteora as Solana’s fair-launch standard. DBC creates a strategic funnel, new tokens launch on Meteora and naturally continue trading on Meteora pools, building network effects and capturing lifetime value across the token lifecycle from launch to mature trading.

Technical Moat and Competitive Barriers

- ◆The integrated product suite creates cross-product network effects that compound as switching costs. Projects launching via DBC naturally establish DAMM/DLMM pools, traders familiar with DLMM’s zero-slippage bins prefer Meteora for new opportunities, and institutional LPs consolidate operations on a single platform rather than fragmenting across Orca (trading only) or standalone launchpads (launch only).

- ◆Moreover, Operational resilience under stress serves as credibility moat. The infrastructure processed $40B+ monthly volume during January 2025 memecoin mania without downtime or performance degradation, demonstrating battle-tested reliability that new entrants cannot claim.

- ◆The LP Army functions as zero-CAC distribution engine competitors cannot replicate. With 10K+ engaged members bootstrapping new pools through coordinated liquidity provision, Meteora eliminates traditional customer acquisition costs while creating immediate depth for launches.

Thesis 3: Launchpad Monopoly & Memecoin Infrastructure Dominance

Exclusive Multi-Vertical Launch Ecosystem

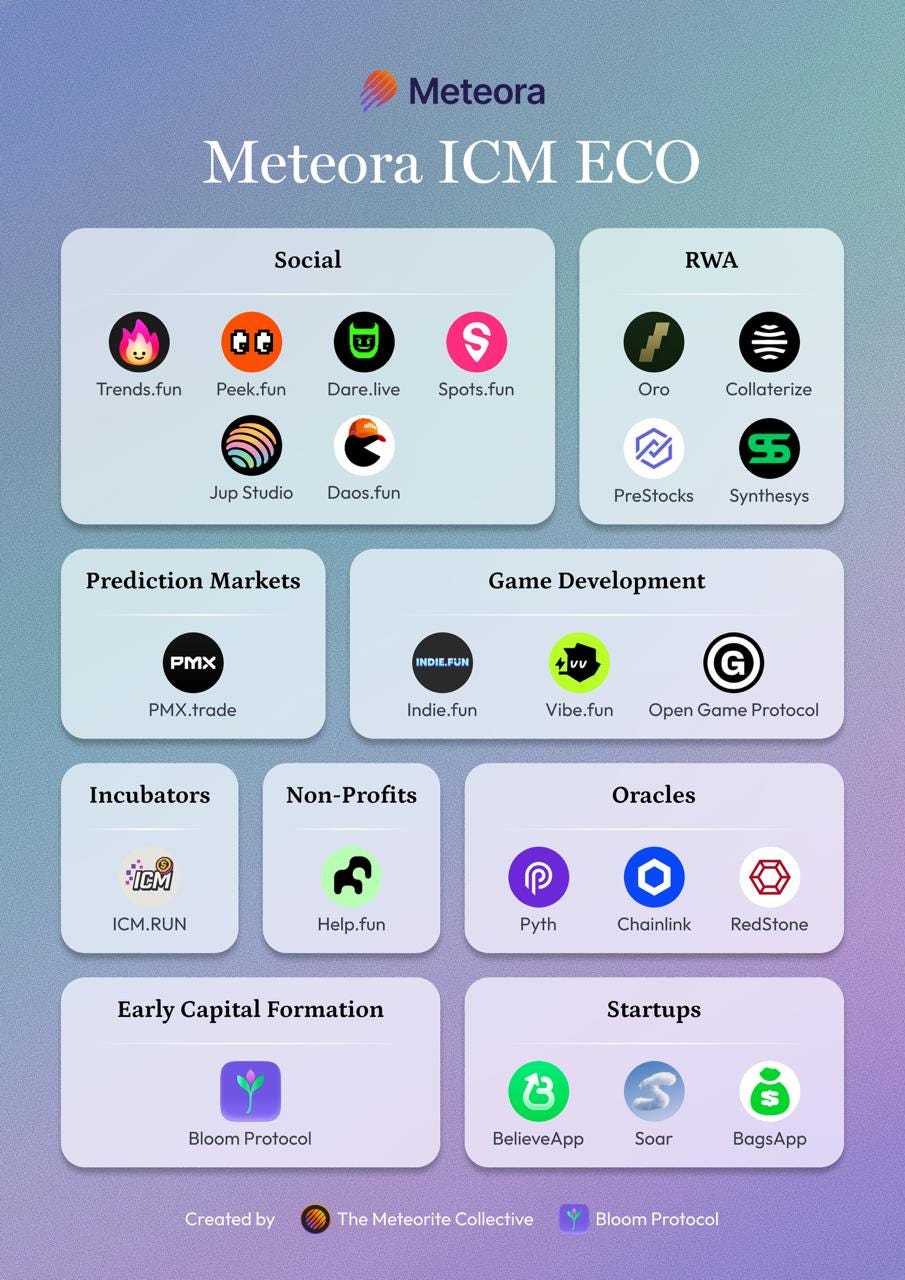

- ◆Meteora’s differentiation stems from monopolistic control over Solana’s institutional launchpad infrastructure. Since launching DBC in April 2025, 422K+ tokens have been created across 14 integrated launchpad partners spanning verticals competitors cannot access: Believe (early-stage founder funding), PMX.Trade (prediction markets), Time.fun (creator monetization competing with Twitch/Patreon), Collaterize (RWA tokenization), and Help.fun/Bags (charitable fundraising/developer recognition). This breadth positions Meteora not merely as memecoin launch venue but as infrastructure for Internet Capital Markets, enabling tokenization of emerging ideas, creators, and real-world assets beyond speculative trading.

- ◆The launchpad monopoly creates structural barriers to entry. Raydium and Orca lack DBC-equivalent infrastructure, forcing reliance on already-mature trading pairs where they compete on commoditized swap fees (0.05-0.3%). Meteora captures 20% of all pre-graduation bonding curve trading, the highest-margin revenue stream generating $17M in Q3 2025 alone from launchpad activity. Post-graduation, tokens continue generating 7.59% perpetual fees on DAMM/DLMM pools, creating lifetime value capture competitors offering only spot trading cannot match.

Institutional Launch Credibility

- ◆High-profile launches serve as proof-of-concept attracting institutional adoption. Meteora’s infrastructure absorbed $TRUMP and $MELANIA launches, alongside $JUP, $WLFI, $YZY, and $PENGU without performance degradation. These viral events create halo effects, each major launch validates infrastructure reliability for subsequent projects requiring institutional-grade launch infrastructure with anti-sniper protections, permanent liquidity locks, and immediate Jupiter integration. Competitors lacking comparable credentialing struggle to attract serious projects beyond grassroots memecoins.

Future Expansion Beyond Memecoins

- ◆Meteora’s strategic positioning targets the mid-segment of on-chain assets where genuine innovation and sustainable liquidity converge, deliberately avoiding commoditized stablecoin pairs (dominated by proprietary AMMs) and pure volume plays (Pump.fun’s domain). As the on-chain economy expands into Internet Capital Markets, trading exposure to creators, ideas, and emerging markets, Meteora’s diversified launchpad ecosystem positions it to capture these flows. Virtuals Protocol launched Solana integration in January 2025, designating Meteora as the exclusive liquidity layer for Solana-based AI agents.

- ◆Meteora’s dynamic liquidity models (DLMM and DAMM) combined with institutional-grade launch infrastructure (DBC) establish a monopoly on major launches while maintaining a strong pipeline of on-chain innovation through launchpad partnerships.

III. CATALYST

Catalyst 1: Meteora Dhabi

Met Dhabi (December 10, 2025) represents Meteora’s first major community conference post-TGE, strategically scheduled one day before Solana Breakpoint in Abu Dhabi. This timing creates a captive institutional audience as all Solana ecosystem stakeholders, venture capitalists, and crypto press converge in a single location, allowing Meteora to announce at Breakpoint’s main stage. The event has been positioned as a “major turning point for Meteora” with explicit announcements across product launches, partnerships, and community initiatives. Agenda suggests potential announcements / sharing on Liquidity Provider, Partners, and $MET. The conference may create opportunity for potential buyback program announcement which would immediately validate Catalyst 2 thesis and trigger re-rating on Meteora valuation (if the team plans to do it).

Historical Precedent Analysis

Conference-driven price catalysts in DeFi demonstrate predictable patterns when combining product substance with token economics, with Jupiter’s Catstanbul (January 25-26, 2025) establishing the benchmark for high-impact community events. Jupiter’s conference generated a 40% price rally from $0.90 to $1.27 through comprehensive announcements including 3B JUP token burn (30% of total supply), 50% fee buyback program, strategic acquisitions (Moonshot and SonarWatch), V2 platform redesign with Ultra Mode and Jupiter Shield, etc. The market response demonstrated sustained conviction rather than transient speculation, with price maintaining $1.05+ for weeks post-event while trading volume surged 3.6x to $1.48B and open interest reached all-time high of $363M. The key insight from Catstanbul’s success: protocols strategically cluster major announcements at conferences to maximize surprise and media amplification, creating information asymmetry that benefits investors positioned beforehand while the broader market remains unaware of pending reveals. This playbook generates concentrated volatility spikes as the market rapidly reprices on unexpected news, with those anticipating conference timing capturing outsized returns during the initial rally phase.

Catalyst 2: Buyback Program & Value Accrual Activation

- ◆Token buyback programs have emerged as the defining value accrual mechanism in 2025 DeFi, with protocols allocating $1.4B to buybacks year-to-date (Source: CoinGecko). Unlike traditional corporate buybacks which signal capital allocation discipline, crypto buybacks serve dual functions: reducing circulating supply while demonstrating protocol sustainability through real revenue deployment.

- ◆Leading protocols have established clear benchmarks, Hyperliquid allocates 97% of revenue, PumpFun 100%, Jupiter 50%, while competitor Raydium directs 12% of trading fees to systematic buybacks. Protocol’s precedent is particularly instructive: the protocol implemented buybacks post-TGE, establishing a timeline Meteora can replicate or accelerate given more mature governance frameworks. With proven revenue generation of $78M trailing twelve months and revenue multiple significantly below peer protocols trading, buyback activation would serve as binary catalyst for institutional re-rating toward comparable cash-flow-positive DeFi protocols.

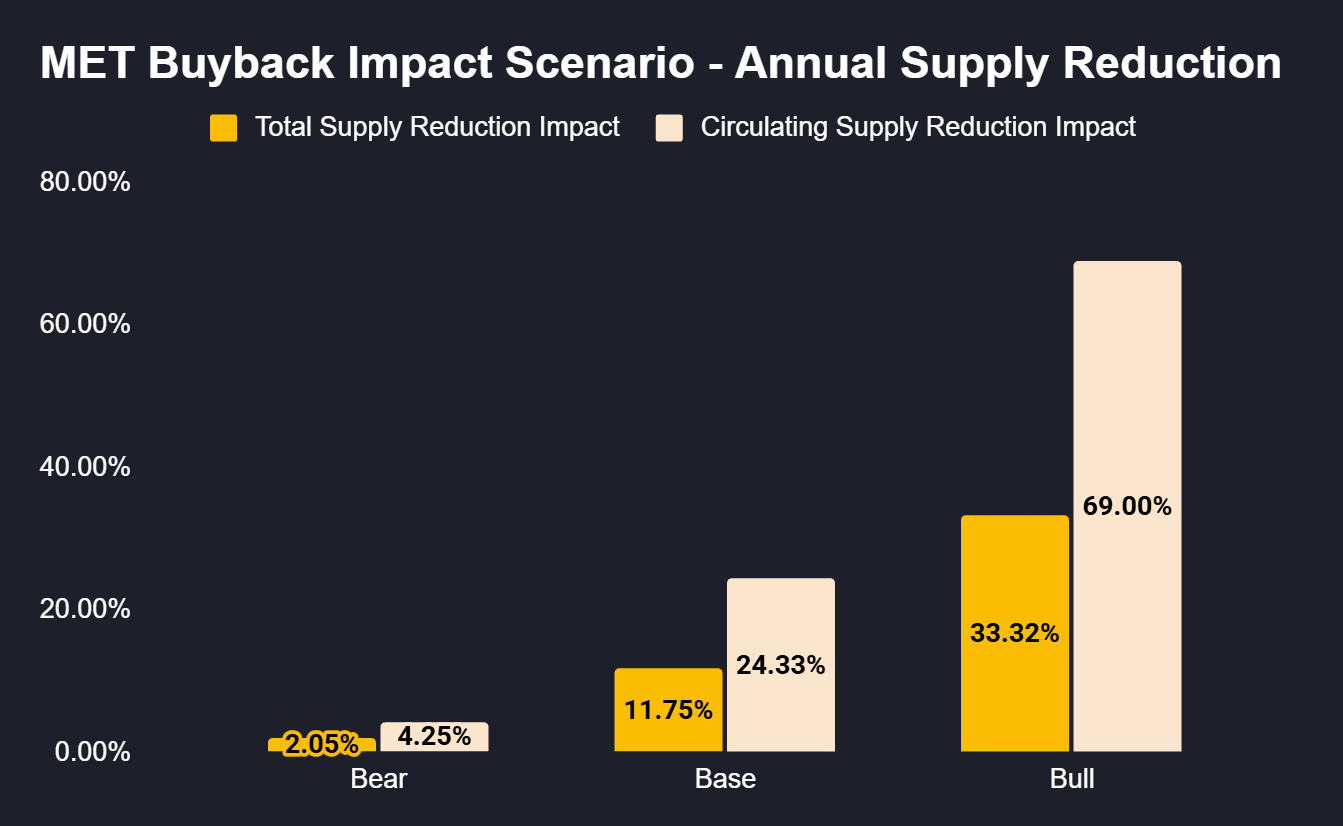

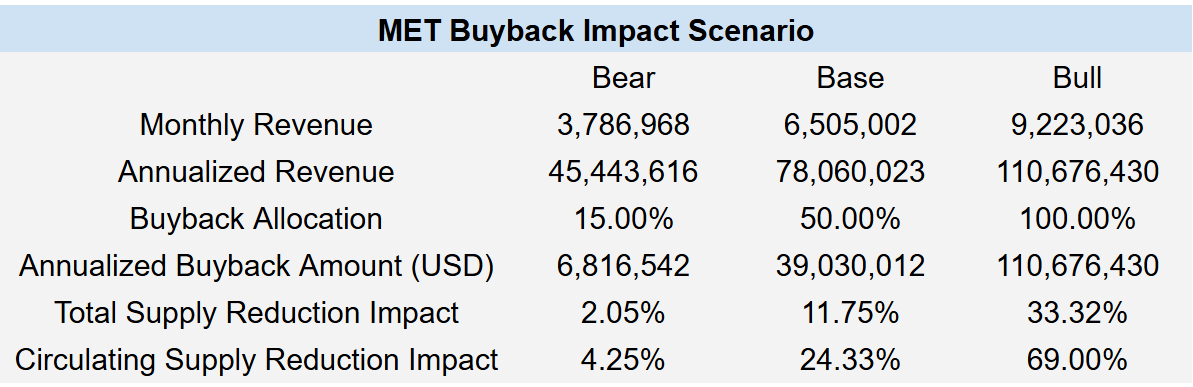

- ◆Meteora’s revenue profile supports multiple buyback scenarios scaled to protocol growth trajectory and competitive positioning requirements:

- ◆Bear case reflects Q4 2024 run-rate ($45.4M annualized) with conservative 15% allocation, exceeding Raydium’s 12% precedent while preserving treasury for product development.

- ◆Base case uses L12M average revenue ($78.1M) with 50% allocation matching Jupiter’s framework, generating $39M annual buyback pressure equivalent to 11.75% of current FDV annually.

- ◆Bull case represents current momentum (L12M peak) with maximum 100% allocation, demonstrating protocol’s capacity to absorb one third of total supply within 12 months under optimal conditions.

IV. VALUATION

Valuation Dislocation vs Peers

Relative Value Analysis

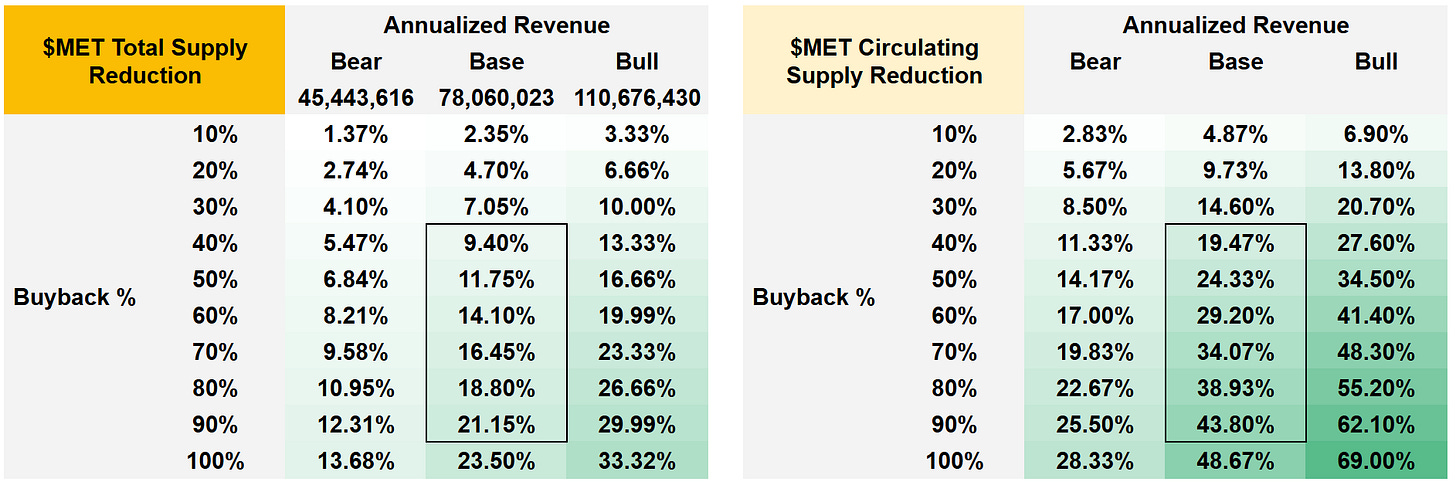

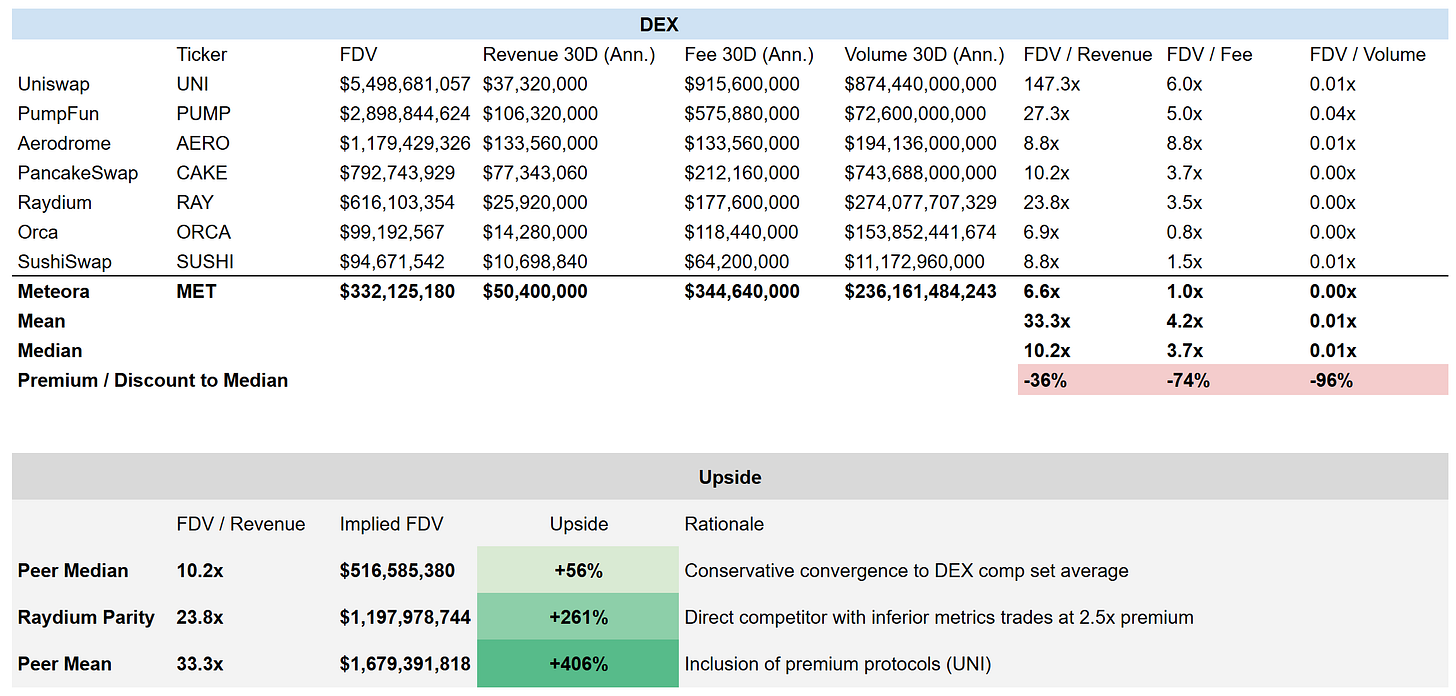

Meteora trades at a 6**.6x FDV/Revenue** multiple against a $332M FDV and $50M annualized revenue, representing a 61% discount to the 17.0x peer median across major DEX protocols. This mispricing exists despite Meteora’s superior operational positioning within Solana’s DEX ecosystem, demonstrable through higher absolute revenue generation than direct competitors, technological moats, and strategic control of high-margin memecoin/launchpad trading infrastructure.

Comparison: Raydium

- ◆Meteora generates 94% higher revenue ($50.4M vs $26.0M annualized) yet trades at a 46% FDV discount ($332M vs $616M) and 72% FDV/Revenue multiple discount (6.6x vs 23.8x). The market assigns Raydium 3.6x more value per dollar of revenue despite Meteora’s superior operational metrics, representing a fundamental mispricing where the operationally stronger protocol trades at a steep discount.

- ◆Raydium facing structural market share erosion following Pump.fun’s November 2024 launch of PumpSwap, which redirects graduated tokens directly to Pump.fun’s swap interface rather than Raydium pools. This integration shift is evident in declining MAU and volume trends, while Meteora demonstrates consistent growth across both metrics through its DBC launchpad partnerships and Jupiter routing prioritization (see Chart 1: Solana DEX MAU & Volume).

- ◆Meteora commands 60% revenue share among Solana’s top three DEXs, generating $4.2M in November 2025 versus Raydium’s $1.9M and Orca’s $868K. This revenue leadership reflects genuine operational superiority rather than temporary positioning, with Meteora capturing disproportionate value from the memecoin trading segment through superior capital efficiency and launchpad infrastructure (see Chart 3: Solana DEX Revenue Market Share).

- ◆Structural competitive advantages justify premium valuation, not discount: DLMM’s concentrated liquidity architecture delivers significantly higher capital efficiency through zero-slippage price bins versus Raydium’s standard CLMM; DAMM’s automated lending yield creates dual revenue streams that Raydium cannot replicate; DBC launchpad monopoly (422K+ tokens, 14 integrated partners) generates exclusive pre-graduation revenue representing 20% of all bonding curve volume that Raydium lacks infrastructure to capture.

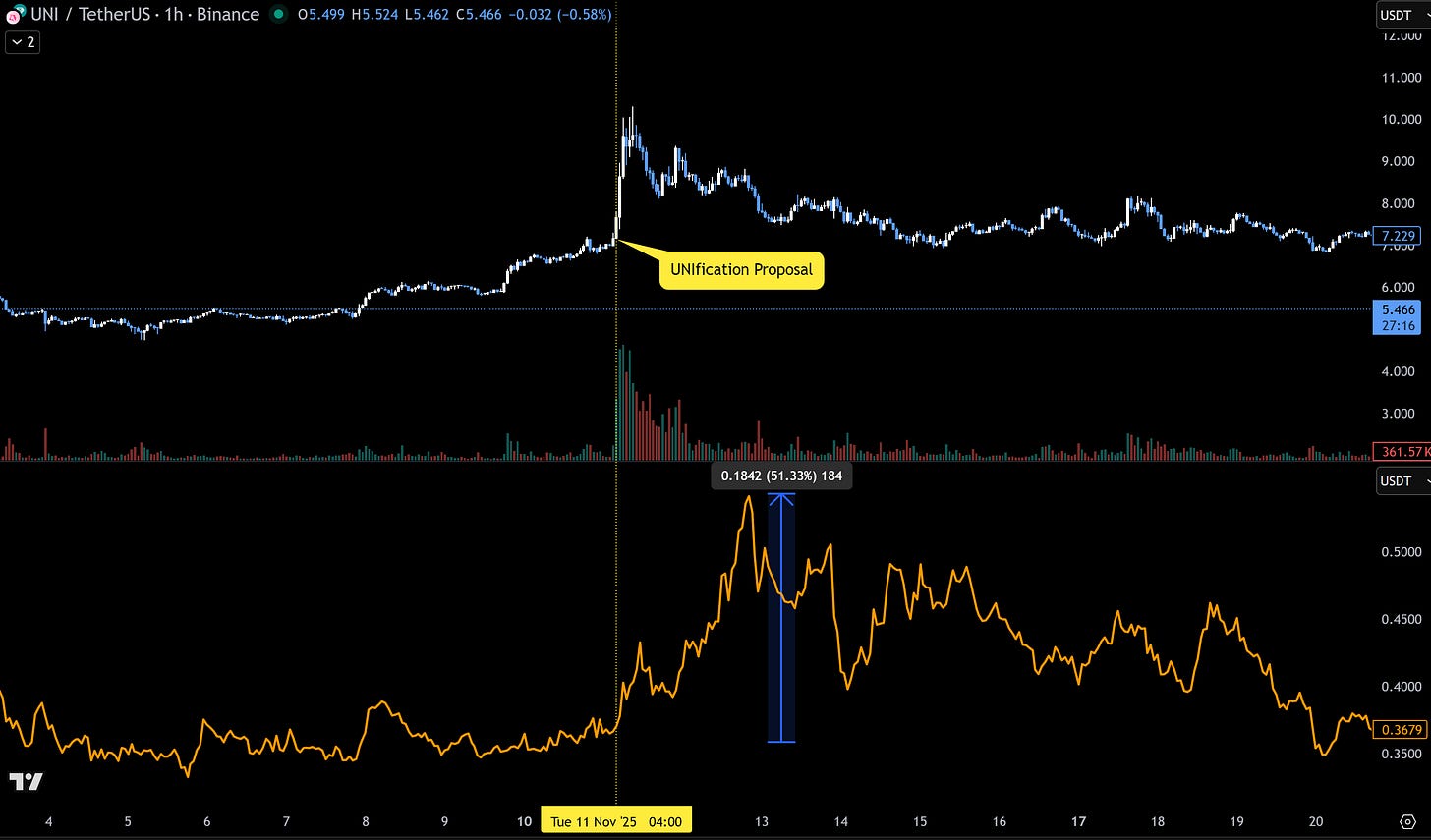

Comparison: Uniswap

- ◆Uniswap’s 147.3x FDV/Revenue multiple exists despite fee switch remaining unactivated (proposal stage, pending Q1 2026 implementation), indicating the market prices in ecosystem infrastructure premium beyond cash-flow generation. The 8.7x premium to peer median reflects Uniswap’s position as Ethereum’s default liquidity layer, integrated across every major DeFi protocol, dominant developer mindshare (v4 hooks creating platform effects), and multi-chain presence establishing network effects competitors cannot replicate.

- ◆This premium persists despite losing market share and facing competition from Aerodrome (Base) and Solana DEXs, demonstrating market willingness to pay for systemic positioning.

- ◆Meteora positioned for comparable Solana infrastructure role yet trades at 6.6x, a huge valuation gap despite superior fundamentals. Meteora already demonstrates infrastructure characteristics through Jupiter routing integration, launchpad monopoly, and institutional launch credibility, but market hasn’t assigned ecosystem premium. Current pricing assumes Meteora remains niche competitor rather than Solana’s liquidity standard, creating structural mispricing as protocol solidifies dominant positioning through network effects and technology moats.

- ◆Market behavior validates narrative-driven re-rating thesis: When Uniswap announced fee switch proposal, Meteora’s price rallied in sympathy (+50% in 2 days), demonstrating investors actively monitor DEX value accrual mechanisms and rotate capital accordingly. This price action confirms market participants recognize Meteora’s comparable positioning but are waiting for catalyst announcement and positive altcoin trading environment to establish the narrative before deploying significant capital. The correlation suggests substantial pent-up demand that releases once Meteora provides clear value accrual framework, similar to how UNI surged 40% on proposal announcement despite fee switch remaining months away from activation.

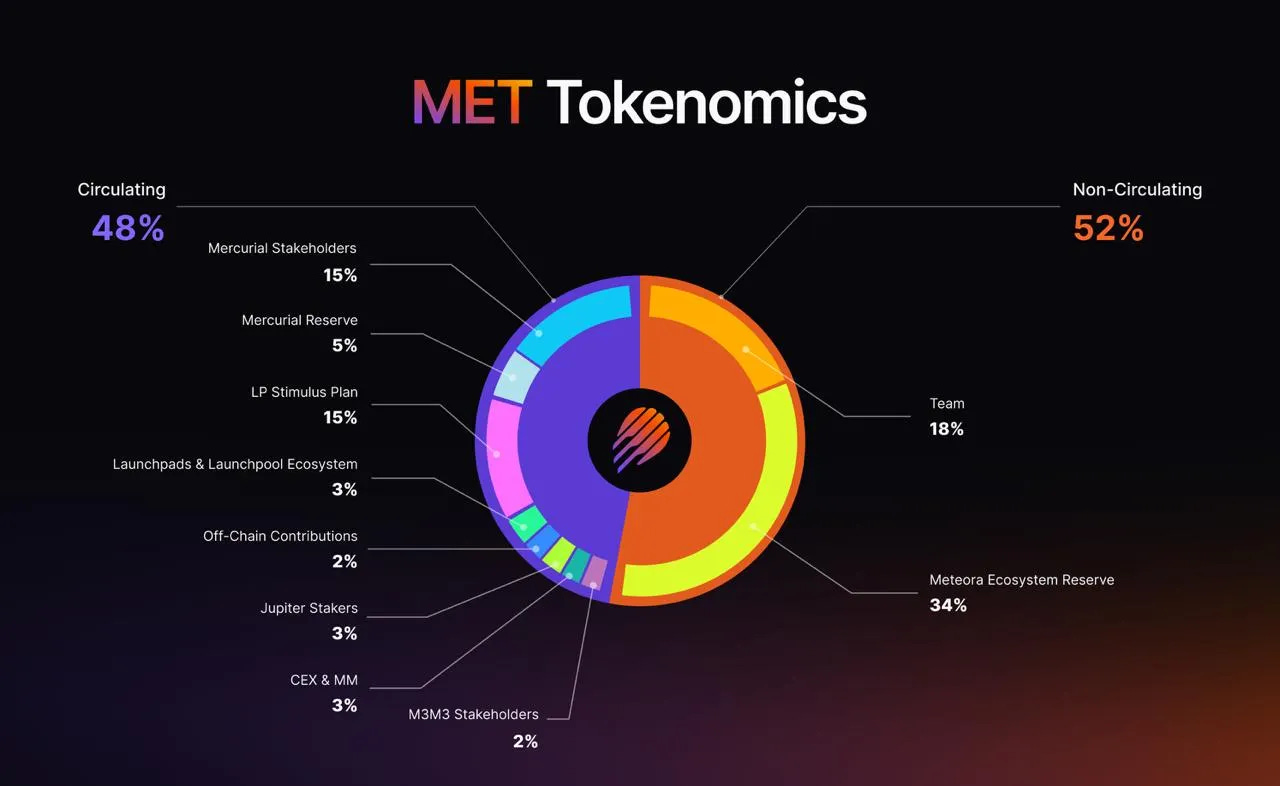

Token Supply Dynamics

- ◆Meteora’s tokenomics structure represents best-in-class design compared to recent DeFi launches that favored low-float/high-FDV models susceptible to manipulation. The 48% initial float eliminates common concerns around future unlock cliffs that plague protocols launching with 5-10% circulating supply, providing price stability and eliminating overhang anxiety among holders.

- ◆The 6-year linear vesting schedule for team allocation (18% of supply) ensures founder alignment with long-term protocol success while preventing destabilizing token dumps.

- ◆Importantly, the remaining 52% non-circulating supply (34% ecosystem reserve, 18% team) operates under controlled release schedules governed by DAO voting, creating predictable supply dynamics that institutional investors can model with confidence

Upside Opportunity

- ◆Current pricing at $0.33 per token represents an ~80% decline from the $1.71 all-time high reached on October 24, 2025 (one day after TGE).

- ◆This valuation dislocation appears driven by general market weakness, initial selling pressure recency bias following the October 2025 TGE sell-off and lingering reputational concerns from the LIBRA controversy, creating a tactical entry opportunity for fundamental investors able to look through temporary sentiment headwinds.

- ◆The token trades below fundamental book value when protocol revenue generation ($is compared against market capitalization of $156M / fully diluted value of $332M. This disconnect suggests the market has overreacted to near-term catalysts (post-TGE selling, legal concerns) while underweighting Meteora’s demonstrated product-market fit and structural competitive advantages.

- ◆The combination of discounted valuation, proven revenue model, superior technology stack, and strategic positioning in the fastest-growing L1 ecosystem creates asymmetric risk/reward favoring long exposure at current prices. Mean reversion to peer multiples alone justifies 56%-406% upside targets without requiring heroic growth assumptions or market share gains.

- ◆The re-rating scenarios demonstrate asymmetric risk/reward:

- ◆Conservative (Peer Median): 10.2x multiple on $50M revenue = $517M FDV (+56% upside)

- ◆Base Case (Raydium Parity): 23.8x multiple = $1.2B FDV (+261% upside)

- ◆Bull Case (Peer Mean): 33.3x multiple = $1.7B FDV (+406% upside to $1.26)

RISKS

- ◆Execution Risk: Ben Chow’s resignation in early 2025 and allegations of insider trading related to the LIBRA token launch created significant reputational overhang that persists despite independent investigation. New co-leadership under Soju and Zen must restore community trust, demonstrate transparent governance practices, and rebuild relationships with partners who may have stepped back pending resolution. Any future governance controversies or team departures could trigger loss of confidence and capital flight to competitors.

- ◆Token Economics: High initial float (48% of total supply) creates potential sell pressure as airdrop recipients, early investors, and strategic partners monetize positions following unlock periods. Large wallet concentration among top holders requires monitoring, as coordinated selling could trigger cascading selling pressure / liquidations in relatively thin trading markets.

- ◆Legal Uncertainty: Class action lawsuit filed in Southern District of New York in April 2025 seeks $50M+ in damages, alleging securities law violations and fraudulent misrepresentation related to celebrity-endorsed token launches. Legal resolution timeline remains uncertain with potential outcomes ranging from dismissal to substantial settlement costs and regulatory intervention. Ongoing SEC scrutiny of DeFi protocols creates regulatory uncertainty, with possibility of enforcement actions against DEX infrastructure providers who facilitate trading in tokens deemed securities.

- ◆Solana Dependency: Network outages, consensus failures, or validator centralization concerns directly impact protocol performance and user confidence, with Meteora’s success inextricably linked to Solana’s ecosystem health. Competition from alternative L1s (e.g. BNB) achieving comparable speed/cost metrics could fragment liquidity and reduce Solana’s competitive advantages. Long-term protocol sustainability may require multi-chain deployment strategy to diversify platform risk, though this could dilute network effects and operational focus.

INVALIDATION

- ◆Catalyst Failure & Negative Market Response: Thesis invalidates if Met Dhabi (December 10) yields no material announcements, buyback program allocation disappoints below certain % of revenue capture, or market exhibits “sell-the-news” drawdown despite positive fundamentals. Additionally, sustained crypto bear market during catalyst window would suppress risk appetite and speculative capital inflows, overriding protocol developments regardless of announcement quality.

Affiliate Disclosures

- •The author and/or others the author advises do not currently hold, or plan to initiate, an investment position in target.

- •The author does not hold an affiliated position with the target such as employment, directorship, or consultancy.

- •The author is not being compensated in any form by target in relation to this research.

- •To the best of the author's knowledge, the information provided here contains no material, non-public information. The accuracy of the information is the responsibility of the reader.

15

0