LiquidLaunch - HyperEVM Beta Play Thesis

- ◆HyperEVM is one of the few L1s that has seen traction. Hyperliquid’s success + the fact that Hyperliquid team still has a decent amount of HYPE tokens leftover for community implies that they might do a secondary HYPE airdrop - which should keep the HYPE flywheel going for a while

- ◆Its hard to find many investable tokens within Hyperliquid’s ecosystem

- ◆Given scarcity + potential expected flows - best to bet on plays that capture both ‘speculation’ and ‘flows’

- ◆This is where LiquidLaunch comes in

Overview

- ◆Couple of things are still working in the market

- ◆Bitcoin

- ◆Hyperliquid

- ◆And select memes

- ◆For Bitcoin

- ◆Its a pretty easy investment case

- ◆For Hyperliquid

- ◆They have fundamentals on their side:

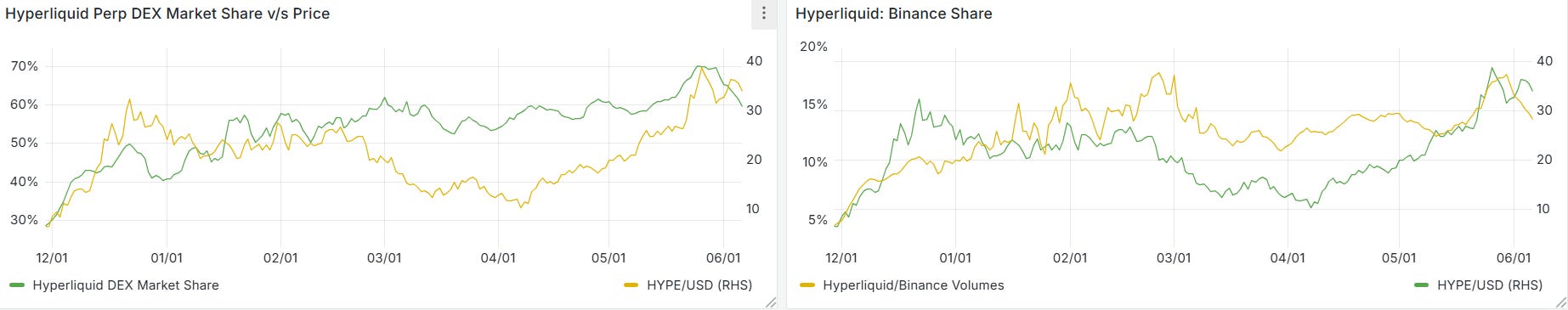

- ◆Derivatives volumes

- ◆DEX volumes on hyperevm with an increasing volume share (relative to global volumes)

- ◆And interestingly - meme performance relative to other ecosystems over the past month or so

- ◆Derivatives volumes

- ◆They have fundamentals on their side:

- ◆For the derivatives side, HYPE itself is the best exposure

- ◆Beyond HYPE, there isn’t much tokenized within the HyperEVM landscape

- ◆Heck, Hype has been the best exposure in general v/s ecosystem plays, as shown in the chart below

- ◆So essentially

- ◆Need to either bet on HYPE alone (safe option) or something that captures HYPE and its memes + fundamental growth

- ◆This is where liquid launch comes in

- ◆LiquidLaunch is Hyperliquid’s first native ERC20 token fair launch platform + a multi market DEX aggregator (LiquidSwap) on HyperEVM

- ◆How does the launchpad work?

- ◆Typical on-chain bonding curve sale - with listing on HyperSwap/KittenSwap (spot DEXs on Hyperevm) once bonding is complete

- ◆Has a 1 hour dev lock to try and reduce rugs

- ◆Charges a 1% fee per trade

- ◆How does the aggregator work?

- ◆Aggregator is called ‘LiquidSwap’

- ◆Combines liquidity from HyperEVM DEXs (Kittenswap, HyperSwap and Laminar)

- ◆Pretty typical DEX. Nothing out of the ordinary.

- ◆Charges a 0.05% fee per trade

- ◆Key innovation/selling point

- ◆Is essentially that its more of a platform that integrates token launchpad/aggregator under one protocol

- ◆Have recently enabled LIQD (Liquid Launch’s toke) staking - with 100% of the protocol’s revenue (in HYPE) being shared with the stakers

The core competition would be:

- ◆Hypurrfun (on launchpad side)

- ◆Has broadly seen traction decline (shown below) - especially post the move to have a minimum threshold of HFUN required to launch a token

- ◆No real competition on the aggregator side at the moment

Traction

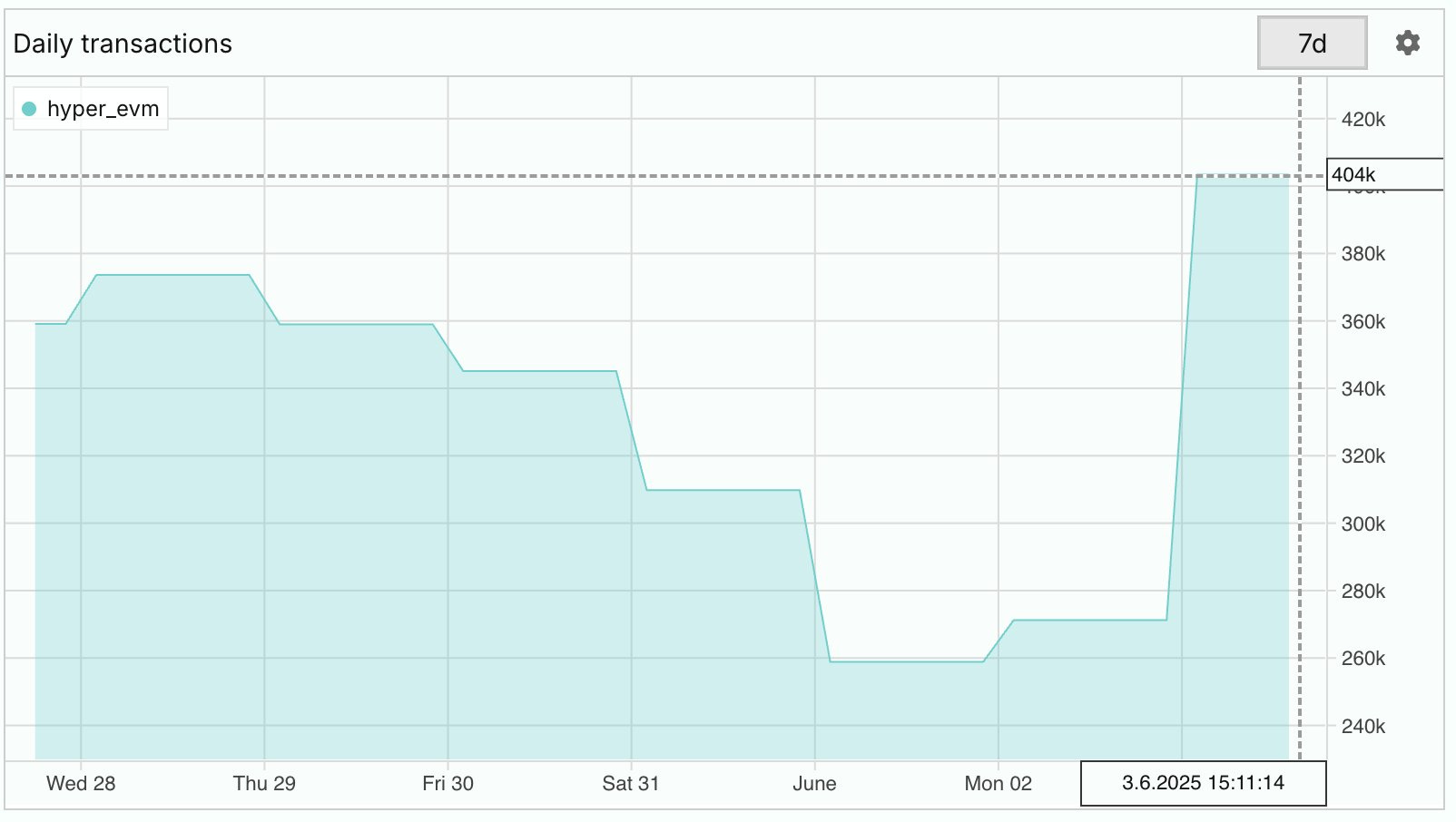

HyperEVM

- ◆There is clearly a sense of traction as evident by Daily unique users > 50k and daily transactions > 404k

LiquidLaunch

- ◆There is no timeseries data on the launchpad side of things that’s publicly available

- ◆Total volume since launch has just crossed >$50m

- ◆This gives us roughly $300k in volumes per day

- ◆Liquidswap (the dex aggregator)- has seen some traction

- ◆$6m volumes per day

- ◆1k in daily users

- ◆Lastly, the protocol recently enabled LIQD staking:

- ◆~304m LIQD have been staked

- ◆i.e. 27% of total supply is staked

- ◆This figure is likely to go up given the team have said they will likely stake their tokens (and not sell once fully unlocked (in July 2025))

- ◆Rewards are in HYPE, which currently equates to $17m (ann.)

Token

- ◆Total supply: 1.19b LIQD

- ◆Circ supply: 1.11b LIQD

- ◆Breakdown:

- ◆Team: 8.91% - locked for 6 months

- ◆Vesting from July 2025 with 20m LIQD per month

- ◆At current price ($0.03), this accounts for 23% of daily volume and ~3% of circ supply being sold per month.

- ◆Have to take the team on their word and assume this won’t be hitting the market anytime soon

- ◆Treasury: 8.91%

- ◆Community: 8.91%

- ◆Team: 8.91% - locked for 6 months

Team

- ◆Partially doxxed:

- ◆https://x.com/lordshisho - core dev. Involved with Sei (Seipex.fi - a fair launchpad - although doesn’t seem to have much traction)

- ◆https://x.com/JoshDev0 - frontend dev

Valuation

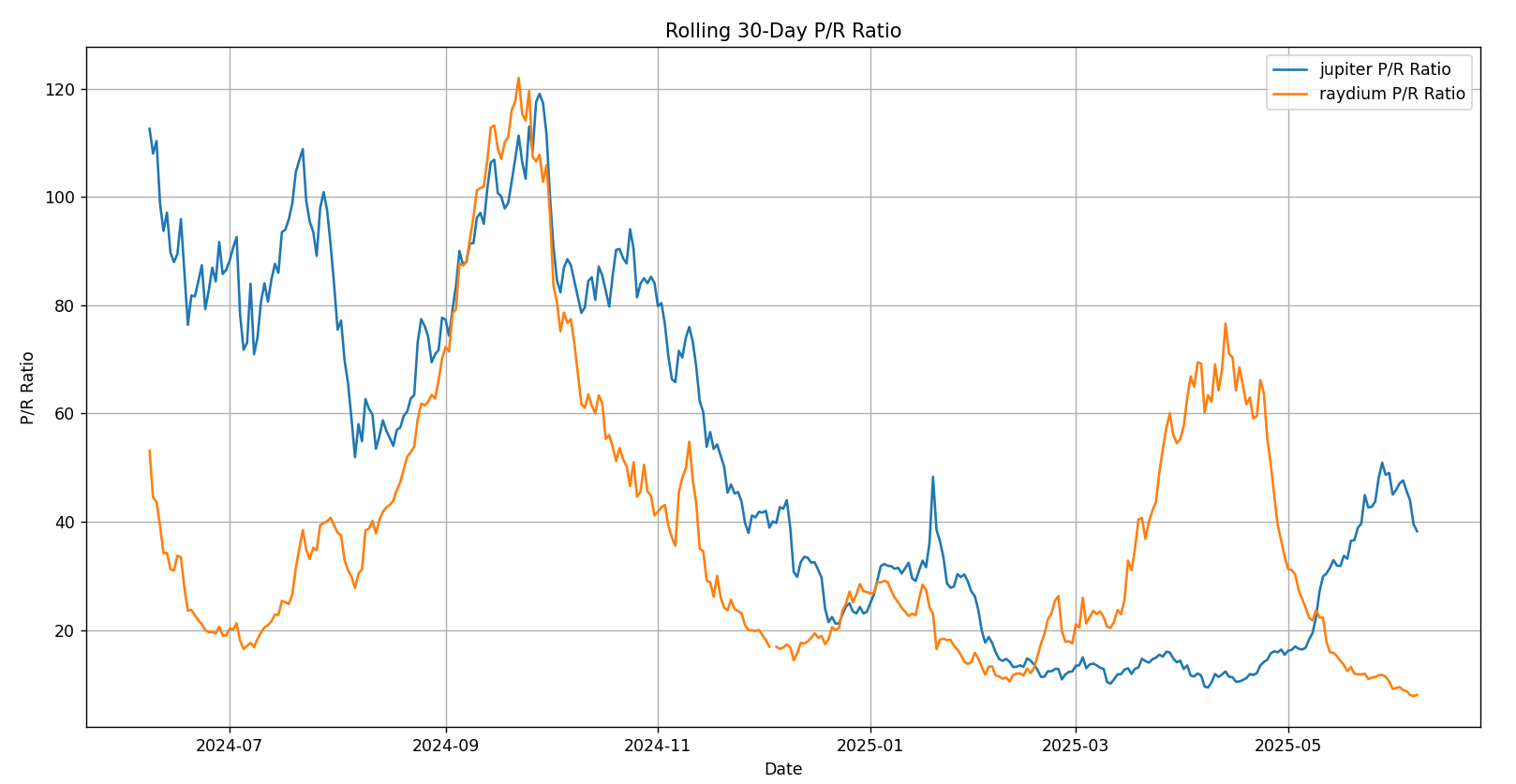

- ◆The protocol currently trades at a $58m FDV with a FDV/Revenue (ann.) i.e. ratio of 25

- ◆For comparison, Jupiter and Raydium (not exact comparisons but still) currently trade at 39 and 8 P/R respectively but have had historical peaks >100 during frenzy periods i.e. before both protocols became more mature.

- ◆So, as far as the current P/R goes - think 25 is roughly fair with the expectation that this can expand to close to a 100 in a bullish scenario.

- ◆Table below summarizes my valuation and expected multiple for LIQD (4.2x)

- ◆The core assumptions are around volumes and P/R expansion

- ◆P/R expansion: covered above - the idea is these speculative plays do experience some pickup in P/R during frenzy periods

- ◆Volumes:

- ◆1.5x increase in base case

- ◆3x increase in bull case: seems reasonable given competitor hypurrfun actually did a 10x increase in volumes during peak periods

- ◆The core assumptions are around volumes and P/R expansion

- ◆The overall weighted implied FDV is $249m, which is actually lower than Hypurrfun’s peak FDV (~$300m) - makes this reasonable. Some discount is fair given we don’t have as much visibility into Liquidlaunch’s launchpad numbers yet

- ◆Given the P/R is a sensitive unit, charts below help visualize how the multiple would look like under base and bull case with different P/R assumptions

- ◆Looking at the potential downside:

- ◆Return/Risk ratio of:

- ◆329/40 = ~8x - that’s chunky enough in my opinion to take the risk

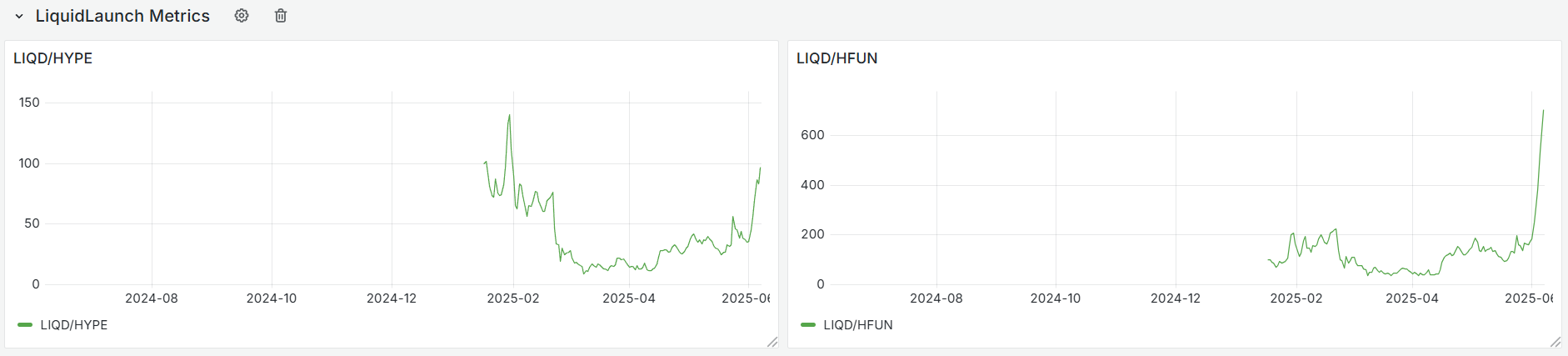

- ◆LIQD/HYPE ratio - is definitely looking interesting

- ◆LIQD outperforming hype since like middle of April. Currently approaching prior peaks in the ratio - key is to see this breaks out

- ◆LIQD/HFUN ratio definitely makes it clear which launchpad platform is currently the preferred choice on Hyperliquid

Conclusion

- ◆Overall - think the core premises + early traction (whatever data is available) + lack of Hyperevm plays makes this a decent bet on the Hyperliquid ecosystem

- ◆Core concern here is:

- ◆Team unlocks - this is definitely a bet on the team and assuming that Hyperevm takes off meaningfully to sustain any sort of team unlock sell pressure

- ◆Its not extreme - so that’s good

- ◆Outside of the above - the other core concern is - probable pickup in competition

- ◆This is inevitable - but these guys have a first mover advantage

- ◆Team unlocks - this is definitely a bet on the team and assuming that Hyperevm takes off meaningfully to sustain any sort of team unlock sell pressure

- ◆Thesis Invalidation

- ◆Proper competitors show up on aggregator side

- ◆Likely to happen so key to monitor aggregator volumes + market share on Hyperevm

- ◆Hyperevm itself loses steam

- ◆Hyperevm/Solana tvl and HYPE/SOL price ratio might be a good reference ratio here - currently does not indicate any signs of slowdown

- ◆Proper competitors show up on aggregator side

Most of the above data is available at the following dashboards (+ helps in monitoring the position):

Affiliate Disclosures

- •The author and/or others the author advises do not currently hold, or plan to initiate, an investment position in target.

- •The author does not hold an affiliated position with the target such as employment, directorship, or consultancy.

- •The author is not being compensated in any form by target in relation to this research.

- •To the best of the author's knowledge, the information provided here contains no material, non-public information. The accuracy of the information is the responsibility of the reader.

0

0