$SYMM - The settlement layer for intent-based perp DEXs

Protocol Overview - SYMMIO

Symmio is a trustless hybrid clearing house that combines on-chain and off-chain elements to act as the communication, settlement, and clearing layer for permissionless derivatives. There are four key aspects to understand:

- ◆It's the first intent-based perps protocol, introducing Automated Markets for Quotes (AMFQs) as an alternative to traditional vAMM or order book models.

- ◆This enables liquidity sourcing from multiple venues, including other chains and CEXs.

- ◆It offers Derivatives-as-a-Service (DaaS) for anyone wanting to create a perps trading protocol.

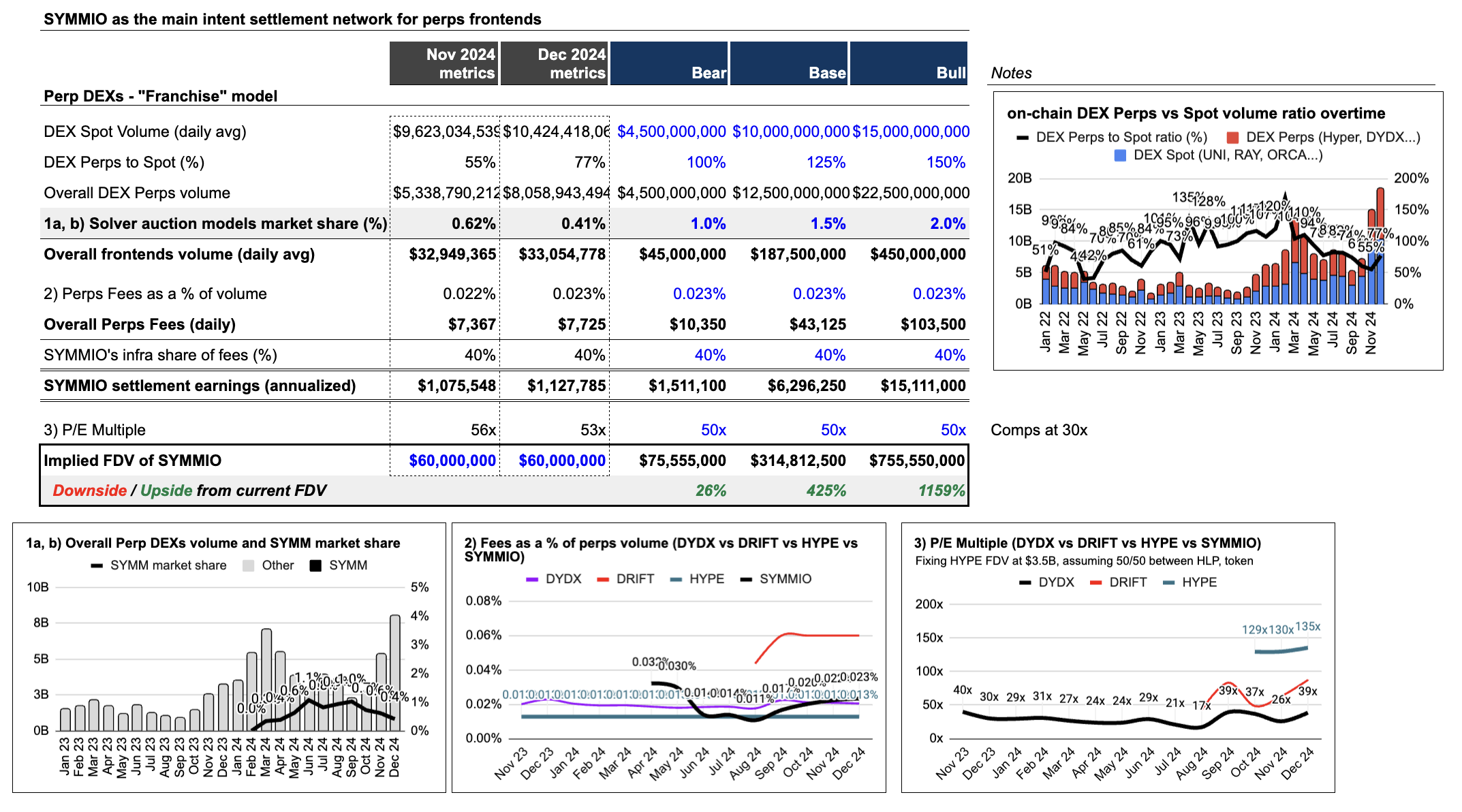

- ◆SYMMIO takes a 40% fee share from all frontends using their settlement layer, which flows back to $SYMM stakers.

Whitepaper → https://github.com/SYMM-IO/docs/blob/main/Whitepaper/SYMMIO_paper_0_8.pdf

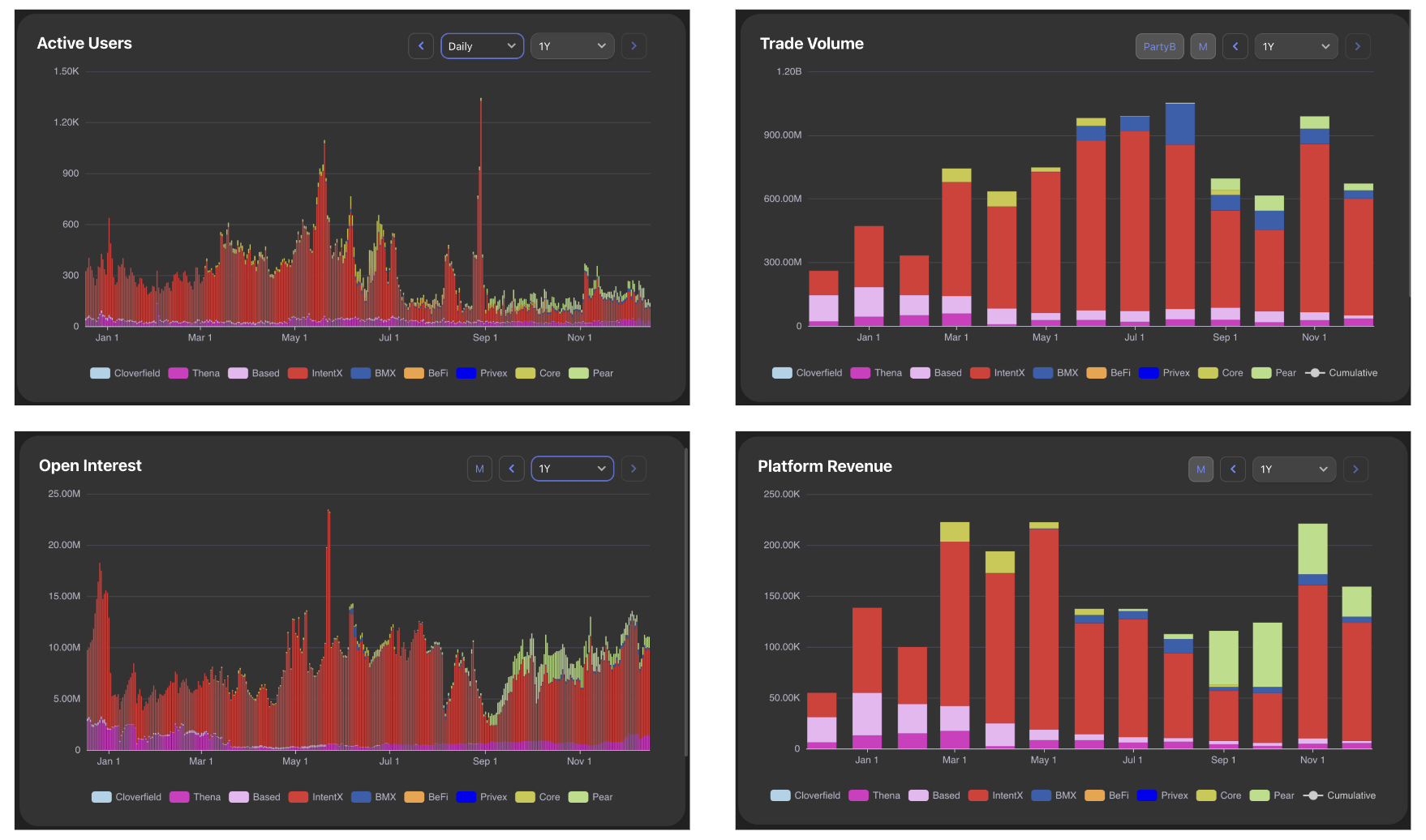

L12Ms Traction

Looking at the last 12 months traction metrics, we can see strong growth across:

- ◆Active Users: daily avg of 250 in L30Ds

- ◆Trade Volume: daily avg of in L30Ds

- ◆Open Interest: currently at $11.5M

- ◆Platform Revenue or “Fees”: L30Ds annualized at $3.8M

- ◆SYMM implied earnings → $1.52M annualized (40% fee share *3.8)

Investment thesis

The investment thesis rests on three main pillars:

- ◆Intent-based models are poised to disrupt the perps landscape:Intent-based models are new to the perps landscape, but I expect them to penetrate and be competitors to CLOB-based DEXs like Hyperliquid and DYDX, and at least fully overtake AMM Pool-based incumbents like GMX, Gains.

- ◆We've seen this happen in Spot DEXs with protocols like COW and 1INCH, and with asset-based bridges with protocols like ACX and DBR.

- ◆On Spot DEXs, intent-based models have been gradually taking share away from DEX’s AMM frontends and Agg Integrators incumbents (going from 7% in Jan 2022 to the current 33% share on Nov 2024).

- ◆Main reason has been due to the increased fragmentation of liquidity and complexity of knowing which AMM will provide you the best pricing for a given swap (routing problem).

- ◆These intent-based protocols allow you to outsource this routing to a sophisticated market of solvers, which will give better price quotes than normal aggregators.

- ◆On Bridges, intent or solver-based models have also been gradually taking share away from message-based protocols (going from 9% on Jan 2023 to current 60% on Nov)

- ◆Similar reason has been due to the increased complexity of doing too much actions when bridging, vs just expressing ur intent to a solver and it handling the execution.

- ◆Solver-based bridges being faster and generally cheaper than message-based bridges that are constrained with having to wait for confirmation on origin chain.

- ◆On Spot DEXs, intent-based models have been gradually taking share away from DEX’s AMM frontends and Agg Integrators incumbents (going from 7% in Jan 2022 to the current 33% share on Nov 2024).

- ◆Perps are next, with intent-based models that outsource execution to third party MMs to penetrate and take share away from incumbents-based models like Pool AMMs (GMX, GNS..), as this new category of perp DEXs is more similar to off-chain orderbooks that use professional MMs with on-chain settlement.

- ◆As shown above, MARKET OPPORTUNITY IS BIG -> a) growing vertical (DEX Perps have grown 3x -from $1.5B daily avg volumes in 2023 to the current $4.5B daily avg volumes in 2024-), b) where a 10% penetration would mean making $600M in daily perps volume vs on spot DEXs and Bridges, where -despite intent-based protocols having 36% and 60% penetration rates-, their daily avg volume is lower, at $234M and $72M, respectively.

- ◆We've seen this happen in Spot DEXs with protocols like COW and 1INCH, and with asset-based bridges with protocols like ACX and DBR.

- ◆SYMMIO's DaaS model positions it as a pick-and-shovel play on the meta of all of these altL1s with have a GTM strategy that involves bootstrapping their ecosystem-specific dapps with huge token-incentives and token grants:

- ◆Already has 9 frontends including IntentX and Pear Protocol, apart from those, 2 of its other frontends got big news this week:

- ◆Upcoming altL1s launch (Monad and Berachain among others) with estimated high FDVs at launch to use their token to incentivize activity on their chain, with PerpDEXs as historically being the main recipients of these incentives.

- ◆This is basically a way of expressing the trade of these altL1s launching at overvalued FDVs and turning their l1 token incentives into Perp DEX frontend fees and into symmio settlement fees (as they take 40% fee share -called “solvers’ settlement fee”- from frontend perps trading fees, which creates direct value accrual to SYMM token holders.

- ◆The settlement architecture as a platform forenabling expressivity for MMs and "asset abstraction":

- ◆Over 275+ supported trading pairs + working on frontends for leveraged memecoin markets and options.

- ◆Instead of having a team implement and being responsible for the most important aspects of the Perp DEX, SYMMIO gives all the tools to the MM directly, for it to have the flexibility of creating their own structured products themselves. MMs are then all competing with each other to come up with the most interesting products, best execution speeds, most applicable risk parameters and engine.

- ◆Main thesis validation so far has been Pear Protocol, one of SYMMIO’s frontends, which simplifies and gamifies pair trading.

Valuation (at $60M entry)

Catalysts

- ◆Onboard more solvers /MMs (only 2 at the moment) to scale OI and launch of the multi-solver network → for trades to be automatically routed to the best solver (decided by implied spread given, reputation from historical execution time, etc).

- ◆Introduction of solver “netting” → to allow for more capital efficiency for MMs → have the ability to have a long matched with a user, and a short with another. With netting, you can net them out together and free more OI space for other traders.

- ◆Sell-side coverage and liquid investors disclosures -buying open-market to then shill it- over the next few weeks (after TGE).

- ◆Potential of a Binance/Coinbase listing down the road.

Affiliate Disclosures

- •The author and/or others the author advises do not currently hold, or plan to initiate, an investment position in target.

- •The author does not hold an affiliated position with the target such as employment, directorship, or consultancy.

- •The author is not being compensated in any form by target in relation to this research.

- •To the best of the author's knowledge, the information provided here contains no material, non-public information. The accuracy of the information is the responsibility of the reader.

2

0